SSTS Trade Alert

A new SSTS trade alert for your evaluation and consideration.

Company Profile

The investment seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of publicly traded equity securities of companies in the Energy Select Sector Index. In seeking to track the performance of the index, the fund employs a replication strategy. It generally invests substantially all, but at least 95%, of its total assets in the securities comprising the index. The index includes securities of companies from the following industries: oil, gas and consumable fuels; and energy equipment and services. The fund is non-diversified.

The Setup

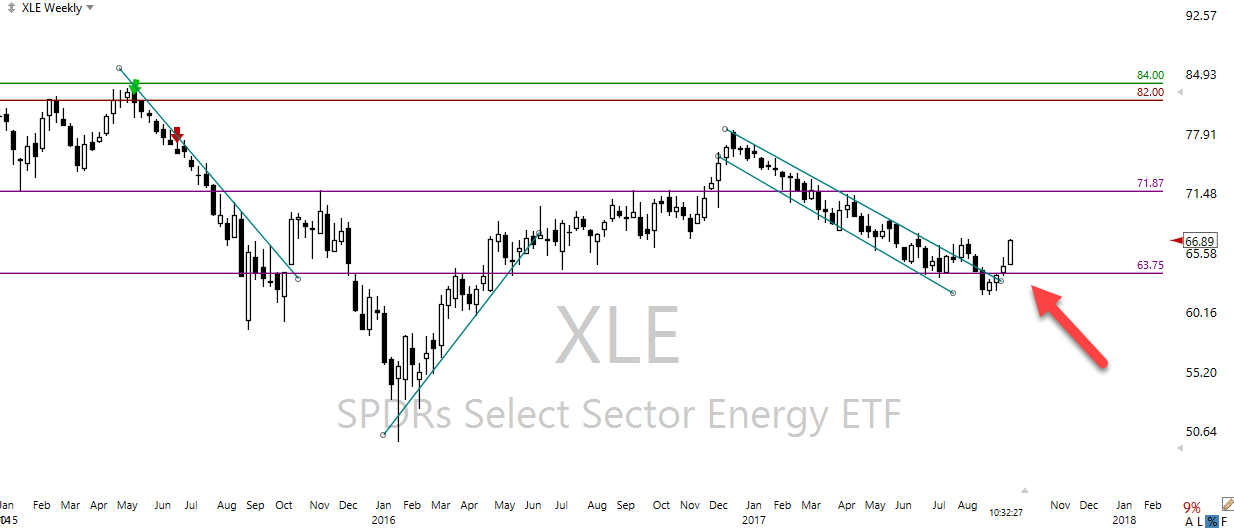

XLE has been in a nasty down trend for most of the year, but it has recently found support and looking higher. I’m looking at weekly chart because I want to hold XLE for a longer term trade. The Hurricane’s Harvey and Irma have had a significant effect on oil supplies and likely will for some time to come. There is also an element of seasonality to this trade idea. As we move toward winter fuel prices, normally rise due to the increased demand for heating. If you take this trade keep in mind, we are expecting to hold the position through the end of the year as long as the technicals continue to support the price action.

Comments are closed.