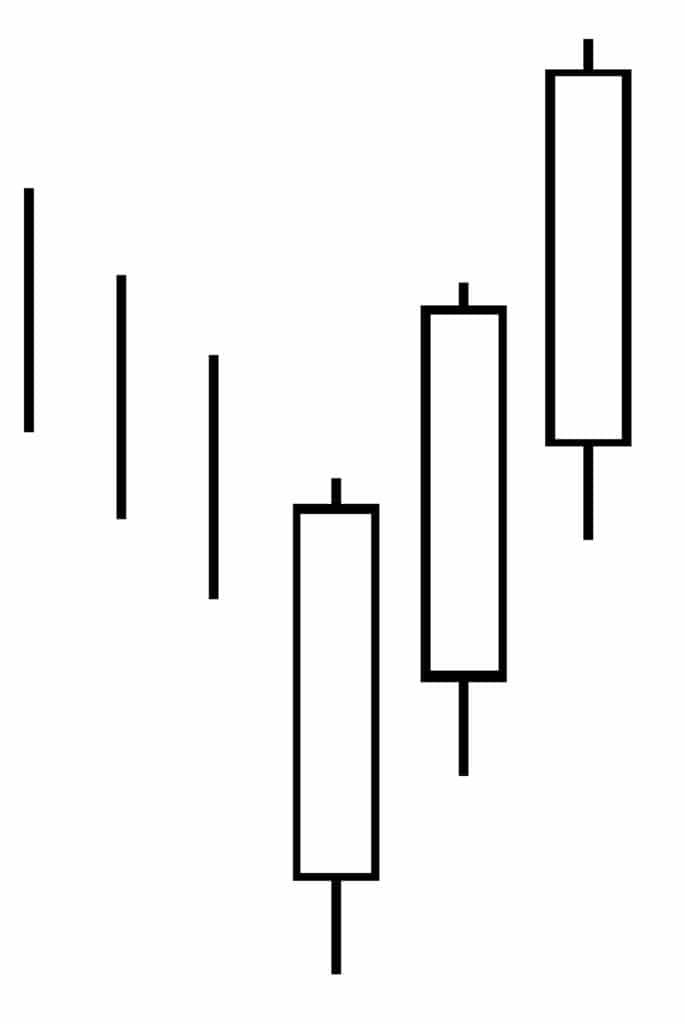

Left, left, left, right, left! Just as soldiers once marched onto the battlefield, the Three White Soldiers candlestick pattern marches upward, creating a staircase-like structure as the price climbs higher and higher. Each candle in this trio of ascending candlesticks opens within the previous day’s body and closes above the previous day. When Three White Soldiers march into a trading session, traders know that a strong reversal has occurred and that the price can be expected to continue its ascension. If you’re ready to learn more about these soldiers’ formation and message, scroll down for all the details.

Three White Soldiers

Formation

The Three White Soldiers candlestick pattern is simple but encouraging. It forms over three trading sessions, and it requires the following criteria:

First, there must be three long and bullish (i.e., white or green) candlesticks in a row. Second, each of those candles must open above the previous day’s open. Ideally, it will open in the middle price range of the previous day. Third, each candle must open progressively upward, establishing a new short-term high. Fourth and finally, it is important that the candles have very small (or nonexistent) upper wicks.

If you notice a very similar pattern occurring during a downtrend, but the three candles are black-bodied and moving progressively downward, you haven’t spotted Three Black Soldiers—in fact, you’ve spotted Three Black Crows. This pattern (like a crow, some believe) is an omen. When you spot it, you can expect the downtrend to continue.

Meaning

So what does it mean when Three White Soldiers suddenly appear on your chart? Should you grab your rifle or offer a peaceful greeting? Well, as we’ve already mentioned, this pattern appears after a downtrend. The bears are exhausted, and the bulls are able to push the price upward. They continue this ascension for three trading sessions, forming a strong reversal. Their continuous progression conveys their strength, and it shifts the market from a bear market to a bull market.

Like the Three Black Crows, this pattern is most useful for long-term traders. It is especially desirable and noteworthy if it is found at the end of a prolonged downtrend.

If you want to understand the nuances of this pattern, don’t underestimate the importance of the candles’ lengths. Hopefully, the second and third candles will be approximately the same size, confirming that the bulls truly are in control. If the third candle is smaller than the other two, however, you may not want to trust the Three White Soldiers. This shift in size reduces the reliability of the signal.

_____

Although the Three White Soldiers is a very rare reversal pattern, it performs reliably and is certainly worth your while! However, before you take heed of the soldiers’ message, be prudent and wait for confirmation. Your patience will be rewarded, and you’ll feel confident marching onward.

If you’re interested in mastering some simple but effective swing trading strategies, check out Hit & Run Candlesticks. Our methods are simple, yet powerful. We look for stocks positioned to make an unusually large percentage move, using high percentage profit patterns as well as powerful Japanese Candlesticks. Our services include coaching with experienced swing traders, training clinics, and daily trading ideas. To sign up for a membership, please click here.

Comments are closed.