Geopolitical fears proved to be no match for the relentless march of the bulls yesterday. By the close of the day, not only had they rejected the fear of the gap down but left behind bullish engulfing candle patterns that held support and trend. However, the substantial rise in gold and oil prices seems to be a huge contradiction to this exuberant bull run. As Iran promises retaliation and the US warns waterway shippers of possible attacks, traders should plan their risk carefully keeping a close on the developments in the middle east.

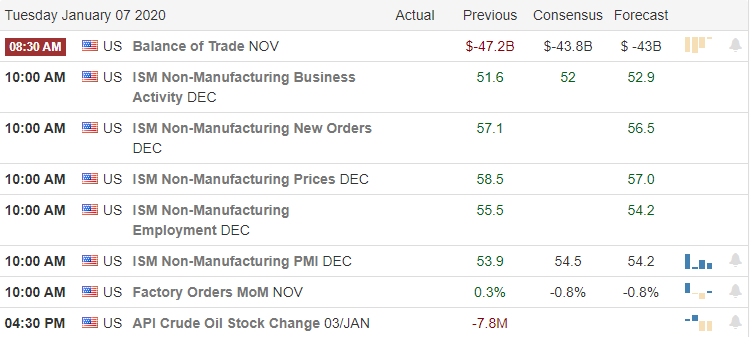

Overnight Asian markets also set aside retaliation fears closing the day green across the board. European markets are also rebounding this morning as fears seem to has subsided. As I write this report US Futures that boldly continued to rally overnight seem a bit more subdued ahead of economic reports on International Trade, Factory Orders and the ISM.

On the Calendar

On the Tuesday earnings calendar, we have 10 companies reporting with none that particularly notable.

Action Plan

The bulls shook off the fear of potential retaliation from Iran yesterday rejecting the gap down lows of the last two trading days. To be honest, I’m not sure where the overall confidence is coming from with Iranian generals publicly speaking about retaliation and US warnings; they are concerned about waterway attacks. Nonetheless, the bulls remain relentlessly in control of the trend that left behind bullish engulfing candle patterns on the DIA, SPY, and QQQ.

Bullish is a good thing but over-exuberant blind bullishness and become very dangerous so let’s hope it’s not the later. With the recent pullback, the T2122 indicator has relaxed, allowing more room for the indexes to extend more to the upside. However, there is a contradiction in the VIX, which shows little to no fear while gold, (GLD) has gone nearly parabolic in its rally over the last few days. Overnight futures continued to push boldly higher as have oil prices that at one point topped $70 a barrel yesterday. With little on the earnings calendar, the market will look to the economic reports on International Trade, Factory Orders and ISM numbers for inspiration. Also, remember geopolitical news could create substantial reversals and price volatility, so plan your risk accordingly.

Trade Wisely,

Doug

Comments are closed.