As we head into the weekend, the tech giants continue to lead the way setting new records while DIA, SPY, and IWM experience some selling pressure. At the same time, 18 million Americans remain unemployed as more than 1.3 million files for benefits. That nearly doubles the number we experienced in the depths of the 2008 and 2009 depression. The VIX continues to display the uncertainty the market faces as a select few stocks continue to rise to new price highs.

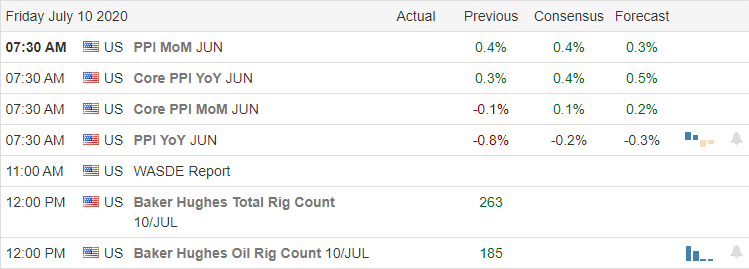

Asian markets closed the day lower across the board as virus infections weigh on recovery hopes. However, European markets are bullish this morning in reaction to hopeful Italian data. US Futures have recovered from overnight lows suggesting modest declines at the open ahead of a very light day of earnings reports and pending PPI data.

Economic Calendar

Earnings Calendar

On Friday’s earnings calendar, we have a light day with just 11 companies stepping up to quarterly results. The report from SJR is the only particularly notable report I see. Remember, the official kick-off to the 3rd quarter earnings season begins next week.

News and Technical’s

Another day of records with the NASDAQ reaching out to new highs while at the same time coronavirus infections in the US topped 63,000 for the first time. More than 1.3 million filed for unemployment last week, and the concern is that the numbers may now start to grow as states struggle in their efforts to recover with the recent surge in the pandemic infections. It’s interesting to note that even at 1.3 million, the number is double the worst numbers we experienced in the depression of 2008 and 2009. A day after the Supreme Court rules against the President, his competitor calls for an end of the era of shareholder capitalism, suggesting higher corporate taxes. Tensions continue to grow as following the impositions of sanctions of three local Chinese officials of China’s ruling Communist party over human rights abuses. China vows to retaliate.

As we head toward the weekend, the imbalance between the tech giants continues with the QQQ holding on to a strong uptrend while the DIA, SPY, and IWM experience selling pressure. I have to wonder what happens to the market if or when profit taking begins in the tech sector. The VIX continues to suggest a considerable uncertainty exists as it seesawed between a low of 26 and a high of 31 handles yesterday. Facing a light day on both the economic and earnings calendar, the market could be sensitive to the news cycle, and price action is likely to remain volatile. Next week begins the 3rd quarter earnings season, which is likely to keep the wild price action going into the near future. Stay focused and flexible, carefully considering the risk you carry into the weekend.

Trade Wisely,

Doug

Comments are closed.