Fueled by just a few tech giants, the market rallied on Monday in a somewhat choppy session even as the Absolute Breadth Index declined. MSFT and AAPl hit new record highs, and the QQQ had a new all-time closing high on Monday as is set to make another new high as the index gaps up this morning. Falling Existing Home Sales and rising COVID infections did nothing to dissuade the bulls from buying.

Asian markets closed in the green across the board in a will evening of trading due to peter Navarro’s comments on the US/China trade deal. European markets are decidedly bullish this morning, with the DAX up more than 2.5%. Ahead of PMI and New Home Sales US Futures point to a substantial gap up open that will likely ink a new record high in the Nasdaq.

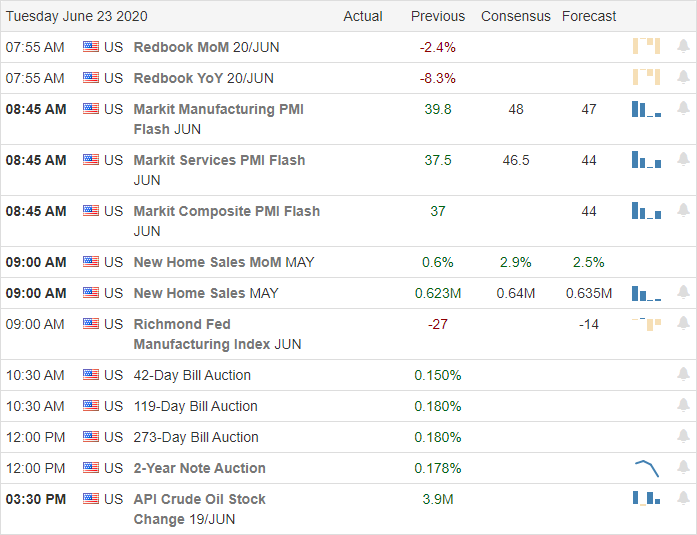

Economic Calendar

Earnings Calendar

On the Tuesday earnings calendar, we have just six companies reporting. The only somewhat notable reports today is LZB.

Technically Speaking

Markets rallied yesterday with MSFT and AAPL reaching out to new record highs. According to the WHO we also set a new world record with more than 180,000 new coronavirus infections. In the US, we saw more than 31,000 new infections reported with Multiple US states experiencing rapidly rising hospitalizations. Protests in the park across the street from the White House attempted to pull down the statue of Andrew Jackson, and in Seattle, a protester held district of the Capitol Hill area now has the attention of Govoner due to the growing violence. We also had a very wild night in the futures market. Futures fell sharply after Peter Navarro was reported to have said the China Trade deal was dead. Later Navarro denies saying that stating the agreement isn’t over and the futures quickly recovered. Yesterday, AAPL announced IOS 14 is coming in September and reported their new iPhones and iPads would no longer include INTC chips. INTC is indicated higher this morning, go figure. Existing-Home Sales slumped substantially last month; however, it seems, any and all bad news only inspires the bulls to buy.

On a technical basis, the DIA and IWM remain below there 200-day averages, but it would appear this morning’s gap up will test them as resistance. The SPY will test the high of Friday’s selloff, and the QQQ will set a new record high at the open today. The Absolute Breadth Index declined on Monday as the majority of the index’s rally came in the big tech giants AAPL, AMZN, MSFT, GOOG, FB, and NFLX. Although the VIX-X pulled back yesterday, it remains quite elevated even as the bulls push to new record highs, so stay on your toes as quick reversals and whipsaws are possible. Today will get readings on PMI and New Home sales with a very light day on the earnings front.

Trade Wisely,

Doug

Comments are closed.