Stock futures dropped sharply as a new trading month began, as tariffs triggered the bears. This moves escalated fears of a full-blown trade war that could potentially disrupt global supply chains. The automotive sector was notably affected, with U.S. automakers that rely heavily on North American supply chains leading the decline. General Motors’ shares fell by 6.8%, while Ford saw a 4% drop in premarket trading. Auto suppliers, including Aptiv and Avery Dennison, experienced losses of 5% and 4% respectively. Engine maker Cummins also saw a 3% decline. However, not all sectors faced the downturn—steelmakers such as Nucor and Steel Dynamics each gained 4% in premarket trading.

European markets took a hit on Monday, marked by notable declines in the automotive sector. Shares of French car parts supplier Valeo plummeted 7.5%, while automaker Renault saw a 1.8% decrease during early morning trading. The German car industry also faced setbacks with BMW’s shares falling by 4%, Volkswagen dropping 6.3%, and Porsche declining by around 4%. Broader market indices followed suit, as Europe’s tech, industrial, and mining sectors each shed more than 2%. Additionally, Germany’s DAX index was 1.7% lower in early trade.

Asia-Pacific markets experienced a significant downturn on Monday. Australia’s S&P/ASX 200 led the losses, falling by 1.79%. Japan’s indices also faced substantial declines, with the Nikkei 225 dropping 2.66% and the Topix losing 2.45%. South Korea’s major indices followed suit, as the Kospi fell 2.52%, and the small-cap Kosdaq plunged 3.36%. Hong Kong’s Hang Seng Index showed a relatively smaller decrease of 0.3%, while India’s Nifty 50 dropped 0.56%. Meanwhile, Chinese markets remained closed in observance of the Lunar New Year holiday.

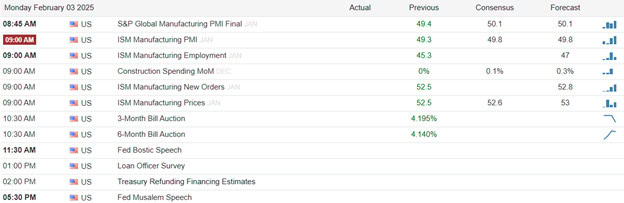

Economic Calendar

Earnings Calendar

Notable reports for Monday before the bell include IDXX, NSSC, SAIA, TWST, & TSN.

After the bell reports include ACM, BRBR, CBT, CSWC, CLX, EQR, FN, DOC, JJSF, KFRC, KD, MTG, NJR, NXPI, PLTR, RMBS, TEM, & WWD.

News & Technicals’

On Sunday, President Donald Trump announced that trade tariffs would be imposed on the European Union (EU) and the United Kingdom (U.K.), though he hinted that a potential deal with Britain could still be reached. In an interview with the BBC, Trump criticized both the U.K. and the EU for their trade practices, claiming they were “out of line,” with the EU being the more egregious offender. He suggested that tariffs on EU goods could be implemented “pretty soon,” highlighting his frustration that while the U.S. takes in various European products, the EU restricts imports of American cars, farm products, and other goods. This move marks another escalation in trade tensions under Trump’s administration.

In January, euro zone inflation accelerated to a higher-than-anticipated 2.5% on an annual basis, driven by a significant jump in energy costs, according to flash data from Eurostat released on Monday. Core inflation, which excludes volatile items such as food, energy, alcohol, and tobacco prices, remained steady at 2.7%, unchanged since September. Meanwhile, services inflation saw a slight decrease, inching lower to 3.9% in January from 4% in December. Notably, energy costs surged by 1.8% compared to the previous year, marking a sharp rise from December’s modest 0.1% increase. This data underscores the ongoing inflationary pressures within the euro zone, particularly in the energy sector.

On Monday, U.S. Treasury yields displayed a mixed performance as investors assessed the economic implications of President Donald Trump’s newly imposed tariffs on goods from key trade partners. At 5:32 a.m. ET, the yield on the 10-year Treasury had declined by 2 basis points, settling at 4.547%, whereas the yield on the 2-year Treasury had risen by over 3 basis points, reaching 4.272%. This variation reflects market uncertainty and investor caution regarding the potential impact of the tariffs on the broader economy. Additionally, investors can anticipate a series of manufacturing and jobs data releases throughout the week, with the S&P Global US Manufacturing PMI and the Manufacturing ISM report both set to be published on Monday. These reports will provide valuable insights into the health of the manufacturing sector and may influence market sentiment further.

According to an investment bank’s forecast, China’s real GDP growth is expected to slow to 4.5% this year, with domestic price growth remaining under pressure due to weak demand, leading to a predicted consumer inflation rise of just 0.4% in 2025. Last year, consumer price inflation barely grew, increasing by only 0.2% year on year. Higher U.S. tariffs could further strain domestic prices as external demand for Chinese goods weakens. On Monday, the Chinese yuan plunged 0.60% to 7.3631 against the U.S. dollar in offshore trading, before trimming losses, as reported by LSEG data. Since Trump’s presidential victory in early November, the offshore yuan has lost 3.7% of its value. Despite the economic challenges, the bank has not revised its 2025 baseline forecast of 4.0% GDP growth for China, considering additional U.S. tariffs of 60% on a quarter of China’s exports and greater policy support from Beijing.

The bulls are in retreat as the tariffs triggered the bears to attack all around the world. Think carefully and try not to panic. Remember big gaps can produce substantial whipsaws but I expect the price action could be very fast and challenging for the next several days.

Trade Wisely,

Doug

Comments are closed.