As the markets recovered from its FOMC temper tantrum a new 10% tariff threat created a quick 180 sending the market sharply lower breaking trends and slicing through key price supports. If you listen to the new spin, you would think the world is coming to an end. Yes, it was very painful, but let’s keep in mind the market had rallied more than 10% in just 2-months, and a pullback was bound to happen. The tariff threat just kicked it into high gear. August is typically a difficult month for the market, but this to shall pass. Keep it in perspective, stay focused on price action, and remember price volatility is likely to remain quite high.

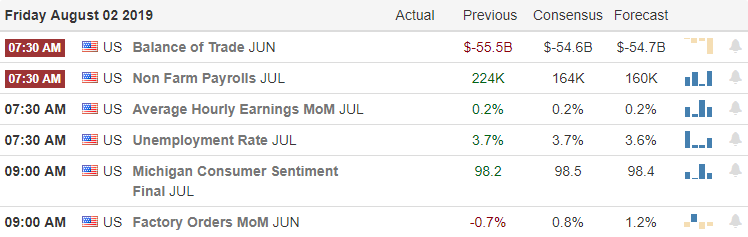

Overnight Asian markets closed in the red across the board in reaction to the tariff threat and the ongoing trade war. European markets are also seeing red this morning as a result. US Futures currently point to a modest gap down open ahead of the Employment Situation number at 8:30 AM Eastern today. Remember, just one day ago we were rallying back toward record highs with 25% tariffs in place, and no one seemed to care that negotiations had stalled. An additional 10% threat is just that, a threat that is still a month away from implementation. Be careful not to get caught up in the drama.

On the Calendar

We get a little break on the Friday Earnings Calendar with just short of 100 companies reporting today. Among the notable reports, ARNC, CVX, XOM, HMC, LYB, NWL, QSR, STX & WPC.

Action Plan

Markets had largely recovered from the FOMC disappointment when the President issued a threat of an additional 10% tariffs on 300 Billion Chinese products. The market did violent 180 in reaction to the threat. The news spin on this threat would make you think the world is coming to an end. Let’s keep in mind that the market just recently hit new record highs with 25% tariffs on Chinese goods and that just one day ago no one was concerned about the failing negotiations. The fact is the market had largely overextended having rallied more than 10% in just 2-months. A pullback was due, and the tariff threat was merely the catalyst.

According to the Trader,’s Almanac August has been one of the toughest trading months since 1987. We certainly kicked it off in style yesterday as the selling created significant technical damage in the charts as it broke trends and important price support levels. The complacency that I have been warning about for the last couple weeks suddenly turned to fear quickly spiking the VIX above a 17 handle. Expect a lost of price volatility as we head into Friday as earnings roll out and the market reacts to the Employment Situation number at 8:30 AM Eastern. If you’re emotional about the market, consider taking the day off and protecting your capital. Have a relaxing weekend and come back Monday, putting all this into perspective focused and ready for the next chapter of the market to be revealed.

Trade Wisley,

Doug

Comments are closed.