Stimulus, what the market wants the most, continues to languish deadlocked and mired in political gamesmanship. Toss in the kickoff of 4th quarter earnings season, a supreme court hearing, and the uncertainty of the coming elections, and we have the makings for extreme price volatility. Stimulus hopes pushed the indexes into a hyper-extended condition yesterday, so there will be a significant amount of pressure for companies to perform at these levels. Stay focused as anything is possible.

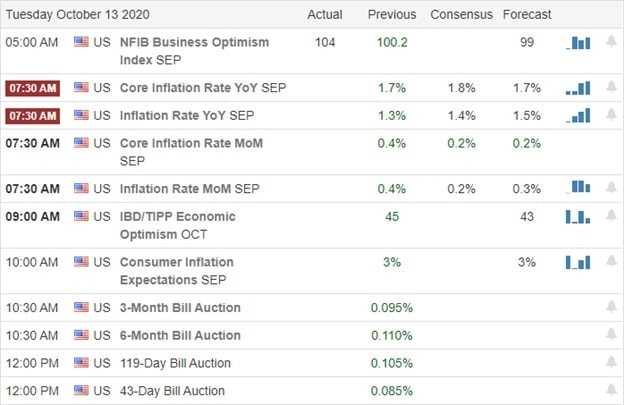

Asian markets struggled overnight but finally managed modest gains after reporting rising exports. European markets are lackluster this morning, currently showing modest losses across the board. US Futures have rallied off overnight lows as earnings roll-out, indicating a possible gap down in the Dow while the NASDAQ points higher lead by APPL and the new iPhone anticipation. Keep an eye on the latest reading on the GDP this morning that consensus suggests will decline.

Economic Calendar

Earnings Calendar

Today begins the kickoff of the 4th quarter earnings season with 14 companies reporting. Notable reports include JPM, JNJ, BLK, C, DAL, FAST, EDU, & WIT.

News and Technicals’

The bulls continued to the rally yesterday even with what they want is still mired in politics with no apparent progress. The President is back on the campaign trail after testing negative for the virus and no longer contagious. He has a lot of catching up to do having been ill with Biden leading significantly in the polls. Senators will begin questioning the new supreme court nominee in a marathon session that will take up the entire day. What that means for the progress of a stimulus bill before the election remains uncertain. Today, Apple CEO Tim Cook will put on his best song and dance act as he unveils the iPhone’s next iteration. There has been a discussion of a significant redesign and the introduction of 5G devices that they hope will trigger a substantial wave of upgrades by the end of the year. Another major distraction will be the Amazon Price sales event that begins on Wednesday.

With JPM firs out of the gate with their earnings this morning, the Futures currently point toa gap down open. However, with several more potential market-moving reports this morning and the latest reading on the GDP before the market opens, anything is possible. Technically speaking, index charts are in a hyper-extended condition, so today’s events will be very critical to inspire the bulls to defend this massive anticipatory rally. Expect price volitility to remain high with an extreme sensitivity to political news surrounding stimulus negotiations. Buckle up for another wild earnings season with a presidential election tossed in for good measure.

Trade Wisely,

Doug

Comments are closed.