The Chinese Yuan declined sharply against the dollar as Asian markets experienced steep declines as markets continue to react to the threat of additional tariffs and a trade war that looks tp persist well into the future. European markets are also seeing red across the board this morning as traders and investors react to mounting trade tensions. After a grizzly weekend of senseless shootings, the US Futures are in a very bearish mood this morning that could open the Dow more than 300 points lower.

After two straight months of bullish price action, the steep selloff comes as quite a shock wiping out nearly have of those gains in just 4-days. Unfortunately, along with the selling comes substantial technical damage with the DIA, SPY, and QQQ gapping below their 50-day averages this morning. With more than 1500 companies reporting earnings this week and the VIX rising sharply, we should expect and plan for very challenging and volatile price action to continue. Protect your capital and remember during times like this that cash is a position often underutilized.

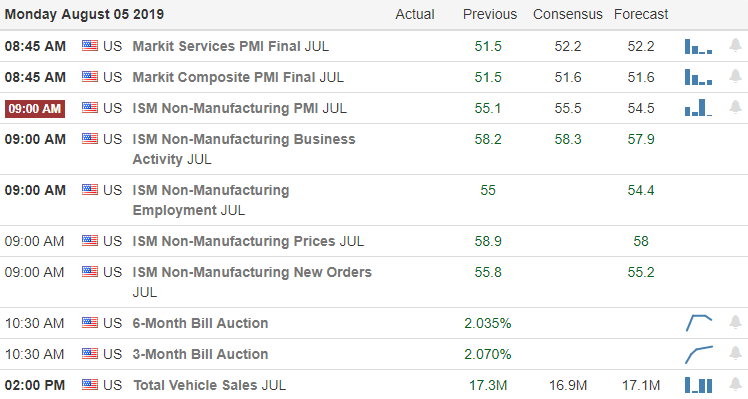

On the Calendar

On the Morning Earnings Calendar, we have more than 230 companies reporting results. Notable reports include TTWO, APLE, CZR, LIN, L, MAR, MOS, O, and SHAK.

Action Plan

We are looking at a punishing market open this morning as markets continue to react to the threat of additional tariffs and a grizzly weekend of senseless shootings. The Chinese Yuan declined sharply against the US dollar overnight as Asian markets closed with substantial losses overnight. The steep rally that began in early June will give back about 50% of Dow gains on the 4th day of declines as the market gaps down at the open.

Substantial technical damage is occurring in the charts with the DIA, SPT, and QQQ gapping below their respective 50-day averages. Adding insult to injury, it looks like the IWM will open below its 200-day average. In my opinion, this correction was overdue, and the harsh reaction is partially due to the complacency seen in the VIX. However, that doesn’t make this sudden pullback any less painful or palatable to trader and investors caught in the turmoil. With a huge number of earnings reports this week, we should expect volatility to remain high and challenging price action to continue. Prepare for a very bumpy week ahead.

Trade Wisely,

Doug

Comments are closed.