Although the selloff yesterday may have been painful for may long traders there was a silver lining showing at the close. After a hard test of their daily 50-averages, all four of the major indexes bounced and closed at or just above this key psychological support. This morning US Futures are currently suggesting a bullish open, but a lot will depend on the morning earnings reports if that holds.

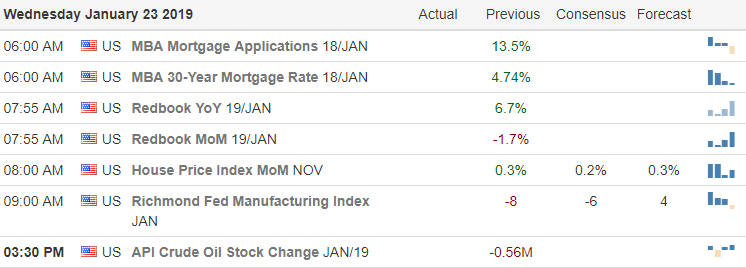

With little on the Economic Calendar today, political uncertainty and global growth concerns, there is significant pressure for companies to perform and prove they can support current price levels. Yesterday the VIX indicated a little fear is coming back into the market. Couple that with earnings and we have a recipe for increased volatility hinged directly upon earnings results.

On the Calendar

On the Earnings Calendar, we have 93 companies reporting today. Notable reports, F, ABT, CP, CTXS, CCI, FFIV, KMB, LRCX, LVS, NG, PG, TXN, UTX, & XLNX.

Action Plan

A decline of 3% in Existing Home Sales yesterday enhanced the premarket fears of an economic slowdown pushing the Dow down 300 points. However, after a hard test of the daily 50-averages, the bulls responded showing at least an initial willingness to defend it as support. As tenuous as it may seem, the uptrend is still valid thus far and perhaps we a consolidation will develop. Earnings Reports will be a key element over the next few weeks that determine market direction.

According to new reports, the Presidents proposal to reopen the government will come to a vote later this week, but the opposition vows it will not pass. Pressure from employee groups continues to increase as some 800,000 continue to work without pay. Futures this morning are pointing to a bullish open currently suggesting a gap up of more than 100 points providing some relief to yesterday selloff. Unfortunately, the bullishness has little to no tailwinds with Asian market having closed nearly flat on the day and European markets mixed but currently mostly lower. With little on Economic Calendar, today Earnings Reports will be in high focus.

Trade Wisely,

Doug

Comments are closed.