After gaping up triggering a brief short squeeze, the market chose to chop sideways the rest of the day once again leaving the biggest price action of the day in the gap. The question for today is whether the Employment number and the Powell speech will inspire for the bulls to push higher or if the bears will get the energy to attack backfilling the gap below. After rallying nearly 850 Dow points in just 3-day on nothing more than a commitment to talk about trade in month one has to wonder if emotion got way too far ahead of common sense?

Overnight Asian markets closed the week with green across the board as Hong Kong protest subside. European markets appear tentative and mixed this morning with the swirling uncertainty of Brexit as they head into the weekend. Ahead of the Employment Situation Report, the bulls are pushing for another gap up open but how the market actually opens will greatly depend on the reaction the 8:30 AM report. Get ready for a wild day as we close out this gap a day week and head into the uncertainty of the weekend.

On the Calendar

On the Friday Earnings Calendar, we have just 10 companies reporting results. About the only somewhat notable report is GCO.

Action Plan

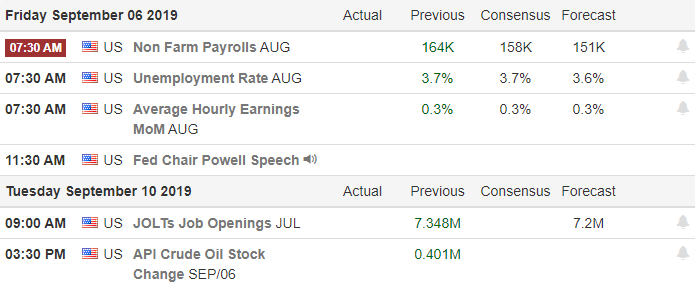

A day after a short squeeze triggered on news that the US and Chian will return to the negotiations table traders are now holding there breath hoping the employment numbers will allow the bullishness to continue. The ADP report and the consensus estimates suggest the economy created more than 160K jobs last month and that the unemployment rate will remain flat. Currently the US Futures, suggest a desire to extend the short squeeze into the weekend. However, a surprise miss would likely quickly reverse that sentiment, and if the number were to come in better than expected what would that mean for the hoped-for interest rate cut?

Technically speaking yesterday’s gap and go nowhere price action saw key resistance levels broken and the DIA, SPY, and QQQ closed above their respective 50-day averages for the first time in more than a month. Unfortunately, the 3-day gap riddled rally has moved the indexes from a short-term oversold condition to a short-term overbought condition according to the T2122 indicator. So the question is can the bulls hold on to this big bullish reversal or will the bear’s attack and fill the big gap below? That leaves some tough choices for traders as we head into the weekend.

Trade Wisely,

Doug

Comments are closed.