With the indexes leaving behind shooting star candle patterns at price resistance levels yesterday seems to suggest that trader’s hopes of progress in the coming trade talks have diminished. Reports that Brexit talks could be failing is not helping as currencies fluctuate, and Oct. 31 deadline quickly approaches. Growing unrest between Turkey and Syria due to the Presidents decision to withdraw US Troops and increasing tensions between Iraq and Ecuador rising oil prices, it’s no wonder market prices continue to so volatile and extremely challenging to trade. It’s truly a day-traders market with all the unrest and news sensitivity and changes market direction in half a heartbeat.

Asian market rallied to close green across the board last night as China television banned NBA broadcasts over Hong Kong protest comments. European market are however decidedly bearish this morning as trade hopes sink and a no-deal Brexit grows. US Future points to a substantial gap down this morning as it faces so much uncertainty in the coming days.

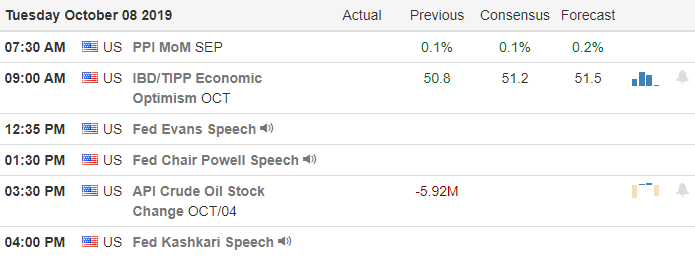

On the Calendar

On the Earnings Calendar, we have 11 companies reporting quarterly results today. Notable reports include HELE, LEVI, and DPZ.

Action Plan

Reports this morning suggest Brexit talks are breaking down quickly hit the currency markets as the sterling fell in reaction. The President’s decision to bring US Troops home from Syria has drawn rebuke from his most staunch supports in Congress and increasing the likelihood that Turkey will invade Syria further destabilizing the region. Oil prices are on the rise this morning, with increasing tensions between Iraq and Ecuador escalate. Ahead of trade negotiations, the US dollar is pulling back, and gold is on the rise this morning, and the Chinese media suspends NBA broadcasts over comments supporting Hong Kong protests.

Top off all this unrest with tough talk from China and hopes of a productive outcome of this week’s talks seems to have greatly dimmed this morning. With the index charts testing price resistance levels yesterday and leaving behind bearish shooting star patterns, a pullback to is not a big surprise. However, the futures seem to be painting a grim picture this morning with a substantial gap down expected amidst all the swirling uncertainty. I continue to expect unruly and price action driven by the news reports that can chop a trader’s account to pieces.

Trade Wisely,

Doug

Comments are closed.