Yesterday a considerable gap and selloff displayed the schizophrenic nature of the current price action as the market attempts to price stocks ahead of a likely turbulent 2nd quarter earnings season. With analysts suggesting a 2020 earnings decline from 20 to 30 percent and the US outbreak numbers hitting new highs, the uncertainty of the path forward is understandable. Expect the volatility to continue as the administration rushes to put out another stimulus package hoping to curb the rising unemployment.

Asian markets closed flat to mostly lower overnight while European decline as hopes of the pandemic recovery fade. US Futures continued to display volatility overnight but currently point higher open ahead of petroleum numbers and the FOMC minute release.

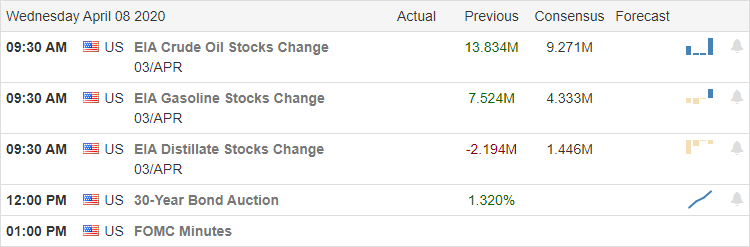

Economic Calendar

Earnings Calendar

We have about 20 companies reporting quarterly earnings on this hump day. Looking through the list, the only notable report today is PSMT.

Top Stories

A new spike in infections and the highest day of deaths the US has seen to date. New York led the way with more than 730 deaths. With now more than 400,000 infections and 12,800 deaths, the market gave up early gains.

The administration is moving forward as quickly with another business stimulus spending bill as we continue to hear about more and companies forced to layoff or furlough 10’s of thousands of employees.

The Euro zone failed to reach a deal on a new stimulus plan after 16 hours of negotiations.

Technically Speaking

After a wild 2-day rally, markets sold off, giving back all of the gains huge early morning gains. The DIA, SPY, and QQQ failed at resistance levels in the daily chart leaving behind dark cloud cover candle patterns adding more technical confusion an already messy set of charts. Yesterday’s virus numbers hit a new daily high disappointing a market that was trying to shrug off the outbreak impacts. The volatility of this market is not only very challenging but reflects the complete uncertainty of the earnings season set to kick off next week.

Today we will get a reading on Petroleum supplies, and we get a glimpse at what the FOMC is thinking with the release of the minutes at 2:00 PM Eastern. Mortgage applications reported a drop of 18% this morning, which is not all that surprising with most of the country concerned about the future of the jobs. During the night, futures remained volatile, and what happens next is anyone’s guess. We will get another round of jobless numbers Thursday morning and will hear from Jerome Powell. Plan your trading very carefully.

Trade Wisely,

Doug

Comments are closed.