Yesterday’s CPI number triggered a rollercoaster ride of market emotions ranging from despair to euphoria, swinging the Dow more than 1400 points from low to high. The big question for today is can it continue facing higher rates, rising inflation, recession, and slowing world economies? With a busy day of potentially market-moving earnings and economic reports, will the rally continue or come to a screeching halt as quickly as it began? The one thing we can say for sure is the wild price volatility makes for a dangerous trading environment that could whipsaw or reverse suddenly, so plan your risk carefully heading into the uncertainty of the weekend.

Asian markets surged higher overnight in reaction to the vast U.S. short-squeeze reversal. This morning, European markets trade green across the board, hoping for a U.K. fiscal policy reversal. As earnings results roll out with a pending retail sales report, U.S. futures point to a bullish open but be prepared for just about anything with market emotions so high. Buckle up; it will likely be another very hectic day of price gyrations.

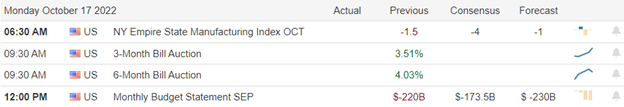

Economic Calendar

Earnings Calendar

The earnings ramp-up begins with several more reports that are potentially market-moving today. Notable reports include C, JPM , MS, PNC, USB, UNH & WFC.

News & Technicals’

Kwarteng’s abrupt departure from a series of international finance meetings in Washington, D.C., comes amid a growing political backlash against the Conservative government’s proposed tax cuts. The debt-funded measures announced on Sept. 23 and estimated to total £43 billion ($48.7 billion) sent financial markets into a tailspin. As a result, Prime Minister Liz Truss is under immense pressure to rethink her economic policies as opinion polls show support for her government has collapsed.

People are increasingly using their social networking “feeds” to discover compelling content as opposed to viewing the media shared by the friends that they follow. Zuckerberg referred to TikTok as a “very effective competitor.” Therefore, it’s important for Meta to develop AI that can recommend a range of content, including photos and text, to users besides just short videos. Twitter said in a court filing that it’s been trying since July to obtain materials related to a federal investigation into his effort to buy the company. “This game of ‘hide the ball’ must end,” Twitter lawyers said in the filing.

President Joe Biden recently claimed the “pandemic is over,” but the extension of the public health emergency indicates the administration does not believe the U.S. is out of the woods yet. The public health emergency, first declared in January 2020 by the Trump administration, has been renewed every 90 days since the pandemic began. The powers activated by the emergency declaration have greatly impacted the U.S. healthcare system and social safety net.

Thursday was a rollercoaster ride, with the Dow futures falling as much as 600 points after the much hotter-than-expected CPI. However, after the open, they trigger a massive short squeeze, recovering the early losses and surging up more than 800 points. The dollar pulled back, and the bond yields eased, helping the bulls to relieve the selling pressure. But, with the hard-to-face economic facts of slowing economies, inflation, and recession, can the rally continue? This morning we will get several potential market-moving earnings and economic reports that could keep the rally going or bring it to a screeching halt. There is a lot at stake, and the potential amlitude of these huge point moves makes for a very dangerous trading environment.

Trade Wisely,

Doug

Comments are closed.