Although the bulls tried to in the premarket to lift bullish spirits, they ran into a roadblock with declining mortgage applications and a substantial miss on Private Payroll’s. Also, those pesky long-term bonds seem to hang in there stubbornly, adding uncertainty. The tech sector suffered the most significant technical damage failing its 50-day average and closing with a lower low that signals a downtrend. With the VIX rising sharply into yesterday’s close, expect price action to remain quite challenging.

Overnight Asian markets sold off strongly across the board, with tech leading the way. European market trade in the red this morning as they closely monitor the long-term bonds. Ahead of more jobless data, the U.S. futures currently suggest a lower open. Still, as we have seen, anything is possible depending on the investor’s reaction as they digest new data. Hold on tight it could be a wild ride.

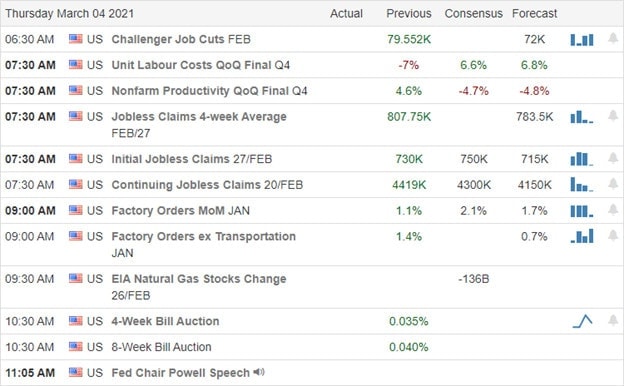

Economic Calendar

Earnings Calendar

As usual, the number of earning reports ramp-up on Thursday, with a total of more than 100 companies revealing quarterly results. Notable reports include COST, BALY, BJ, AVGO, BURL, CNQ, CHUY, CIEN, FRGI, GPS, GWRE, KR, MIK, SDC, SWBI, & TTC.

News & Technicals’

Yesterday’s premarket bullish ran into a roadblock after learning that mortgage applications stalled and Private Payrolls registered a substantial decline. We spent the rest of the day with whipsawing price action that ultimately left behind bearish price patterns. The biggest concern is the QQQ failure of its day moving average and making a lower low, signaling a downtrend. Apple is now the target of a government antitrust probe in the U.K., adding to the suffering tech sector’s woes. SpaceX made headlines yesterday after a successful rocket landing of a high-altitude test flight. However, after landing, the rocket exploded.

The technical troubles we now see in the tech sector could make it very difficult for the DIA and SPY to gain headway due to the massive weighting that these tech giants hold in the indexes. While the SPY managed to hold at price support, if the QQQ remains under pressure, the big tech has the weight to pull it under. After failing the 50-day average, we can’t rule out the possibility of a 200-day average could be tested, which means another 10% could be shaved off of the QQQ. Today we face another job number with the Weekly Jobless claims and will follow that up with the Employment Situation number before the bell on Friday. With VIX elevated above 26 handles, be prepared for more gaps and whipsaws to challenge a trader’s skill.

Trade Wisley,

Doug

Comments are closed.