After an evening of missiles, turmoil, and rising tensions that sent markets tumbling around the world, the message from the President that All Is Well, restored frayed nerves and market prices. Shortly after the news of the attack, the Dow Futures plunged more than 400 as a sobering reminder just how quickly geopolitical events can affect the path forward for the market. Traders should carefully consider this and plan their risk accordingly to protect themselves as tensions between the countries remain very high.

Asian markets closed seeing only red overnight as oil and gold prices spike after the Iranian missile attack. European markets have, however, recovered overnight losses currently holding modest gains while closely monitoring developments. US Futures ahead of earnings and economic reports now suggest a flat to slightly bullish open. Market jitters have subsided for now keep one ear to the news as massive price volatility could be just one report away.

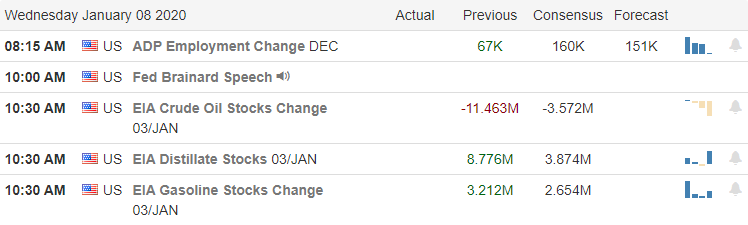

On the Calendar

On the hump day earnings calendar, we have 24 companies reporting quarterly results. Notable reports include STZ, BBBY, LEN, MSM & WBA.

Action Plan

After Iran fired more than a dozen missiles at Iraqi airbases that house US troops. According to reports, there were no lives lost in the attack but came with a warning from Iran to withdraw forces from the area to avoid additional actions. Markets around the world quickly reacted with the US Dow Futures sinking more than 400 points while gold and oil prices spiked. However, after the President issued a statement last night that all was okay, markets have recovered, but it is a sobering reminder of how quickly geopolitical events can affect market prices.

As tensions continue, traders should plan their risk accordingly and always have a plan to protect your capital if this conflict continues to escalate. As of yesterday, the bullish trends remained intact, although the price action was choppy, reflecting the uncertainty of the day. US Futures now indicate a flat to slightly bullish open ahead of some notable earnings and economic report. In times of turmoil, we naturally first think of how the situation effect our money and ourselves. May I suggest we all take a minute to remember our troops standing in harm’s way and their families undoubtedly stressed and worried about their loved ones. We risk only money, and they risk their lives to protect us!

Trade Wisely,

Doug

Comments are closed.