Relief Rally?

Although volume remained light a relief rally is still a welcome site! The bulls found the energy to not only defend the support of yesterdays gap down but also push the Dow into the November 20th gap. A good start but let’s keep in mind that with so much technical damage and the threat of increasing tariffs just around the corner the price action is likely to remain very challenging. The QQQ is only a couple days away from joining the IWM with a death cross, and the DIA still has the 200-day average as resistance.

Although volume remained light a relief rally is still a welcome site! The bulls found the energy to not only defend the support of yesterdays gap down but also push the Dow into the November 20th gap. A good start but let’s keep in mind that with so much technical damage and the threat of increasing tariffs just around the corner the price action is likely to remain very challenging. The QQQ is only a couple days away from joining the IWM with a death cross, and the DIA still has the 200-day average as resistance.

Of course, a trade deal with China would be a game changer but now seem less and less likely as the rhetoric continues to fly between the two countries. Asian markets closed sharply higher overnight, and European markets are currently mostly higher as well. As a result, the US futures are pointing a gap up open of more than 100 points this morning. As nice as it is to see the bulls running, please remember to respect the overhead resistance. Chasing into the market on a gap up near price resistance levels is a dangerous business. It would be wise to wait and see if buyers step in to support the gap or if profit takers take the gift provided by the gap.

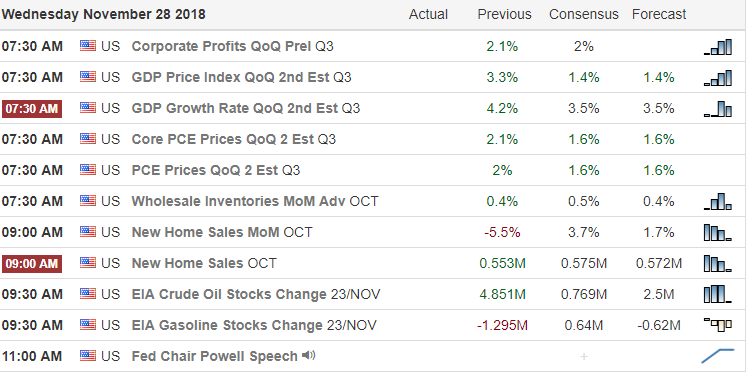

On the Calendar

On the Earnings Calendar, we have just under 40 companies expected report so please continue to check new and existing positions as part of your daily preparation.

Action Plan

After a concerning gap down yesterday the bulls hung in there defending support moving the indexes higher even though volume remained quite low. The big gap down created on 11/20/18 now has a good chance of being filled and challenging the nest level of resistance. Unfortunately, the QQQ is only a couple days away from joining the IWM with a death cross. We should expect challenging price action and volatility to continue.

Even with the current relief rally, we must keep in mind that the overall markets are still in a downtrend. That means we have to be on the lookout for possible failures as we approach resistance levels. This morning the futures are pointing to a gap up open, and we all know that brings with it the possibility of the dreaded pop and drop pattern. If you’re already long, remember that gaps are gifts and consider taking some profits. However, if you’re looking to enter a new position, make sure there is follow-through buying supporting the gap.

Trade Wisely,

Doug

Comments are closed.