Stock futures remained relatively stable on Tuesday following record highs for both the Dow Jones Industrial Average (DIA) and the S&P 500 (SPY). Information technology stocks were the standout performers, driving the S&P 500 up by nearly 1.4%, with Nvidia’s 2.4% rally to a record close providing significant upward momentum. The focus now shifts to corporate earnings, with major financial institutions like Goldman Sachs, Citigroup, and Bank of America set to report. Additionally, earnings from United Airlines, Walgreens Boots Alliance, and Johnson & Johnson are anticipated. Investors are also keeping a close watch on manufacturing data and comments from several Federal Reserve speakers, which could influence market sentiment.

European stocks showed a mixed performance on Tuesday as third-quarter earnings reports began to emerge. The market saw a divergence across sectors, with travel stocks rising by 1.3%, while oil and gas stocks fell by 3.15%, mirroring declines in the oil market. Telecom stocks gained 1.39%, largely driven by a significant 8.5% jump in Sweden’s Ericsson, which exceeded earnings expectations despite a 4% drop in year-on-year sales. Meanwhile, the U.K.’s statistics agency reported that average wages excluding bonuses increased by 4.9% year-on-year, though earnings including bonuses fell to a two-year low of 3.8%.

China’s stock markets experienced a significant downturn on Tuesday following the release of disappointing September trade data. Both exports and imports fell short of expectations, with exports rising only 2.4% and imports increasing a mere 0.3% compared to the previous year. This led to a 2.66% drop in the CSI 300 index and a 3.67% decline in Hong Kong’s Hang Seng index. In contrast, South Korea’s Kospi index saw a modest gain of 0.39%, buoyed by revised trade data showing a substantial surplus of $6.7 billion for September. Japan’s Nikkei 225 and Australia’s S&P/ASX 200 also posted gains, rising 0.77% and 0.79%, respectively.

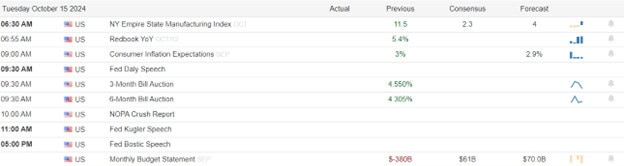

Economic Calendar

Earnings Calendar

Notable reports for Tuesday before the bell include ACI, BAC, C, SCHW, GS, JNJ, PNC, PGR, STT, UNH, & WBA. After the bell reports include FULT, HWC, IBKR, JBHT, OMC, PNFP, SGH, & UAL.

News & Technicals’

Nvidia shares have reached an all-time high, driven by soaring demand for it’s artificial intelligence chips. Major tech companies like Microsoft, Meta, Google, and Amazon are purchasing Nvidia’s graphics processing units (GPUs) in large quantities to build extensive AI computing clusters. This surge in demand has propelled Nvidia’s market valuation to over $3.4 trillion, underscoring its pivotal role in the AI revolution and solidifying its position as a leading player in the tech industry.

A federal appeals court has expedited the Commodity Futures Trading Commission’s (CFTC) case against the Kalshi exchange, which is offering contracts that function as bets on U.S. political elections. These contracts, facilitated by Kalshi and Interactive Brokers, allow bets on outcomes such as the presidential election, U.S. Senate races, and which party will control Congress. Notably, Kalshi has already booked over $7 million in contracts on the presidential race between former President Donald Trump and Vice President Kamala Harris. The court’s decision to fast-track this case underscores the regulatory scrutiny surrounding the legality of such political betting markets.

Ericsson reported adjusted third-quarter earnings of 7.327 billion Swedish crowns ($0.7 billion) on Tuesday, significantly exceeding the analysts’ forecast of 5.75 billion crowns. This impressive performance was largely driven by robust sales growth in North America, which saw a year-on-year increase of over 50%. The company’s strengthened position in the U.S. market, bolstered by securing a major contract with AT&T last year, where it outperformed Finnish competitor Nokia, has been a key factor in this success.

Federal Reserve Governor Christopher Waller indicated on Monday that upcoming interest rate cuts will be more measured compared to the significant reduction in September. He emphasized a gradual approach to lowering the policy rate over the next year, despite short-term uncertainties. Waller’s comments come amid mixed economic data, which the Fed is closely monitoring to guide its policy decisions. This cautious stance reflects the Fed’s aim to balance economic growth with inflation control.

With the DIA and SPY sporting fresh record highs we now face the ramp up of earnings reports likely to inspire significant price volatility. The rising dollar and bond yields continue to be a contradiction to the market’s bullish enthusiasm and the T2122 indicator continues to flag a short-term overbought condition. Stay with the trend but tighten stops as it would only take a minor stumble to trigger a profit taking wave.

Trade Wisely,

Doug

Comments are closed.