Yesterday was a record-breaking day with the QQQ smashing through all-time highs with the SPY and DIA following closely behind. If the huge round of earnings today continues to inspire the bulls perhaps DIA and SPY can join the party with new record prints. During the night Australia’s market celebrated with the US touching a 10-Year High while Asian markets struggled, closing mixed but mostly lower. European markets appear cautious this morning, currently trading mixed but mostly flat.

With more than 200 companies reporting earnings this morning US Futures seem to be taking a wait and see attitude in the pre-market trading. As a result roll in anything is possible so stay focused on the price action and guard yourself against getting caught up in morning hype making emotional decisions. Expect considerable price volatility this morning with possible record-breaking attempts as markets react always keeping in mind the possibility of reversal if earnings happen to disappoint.

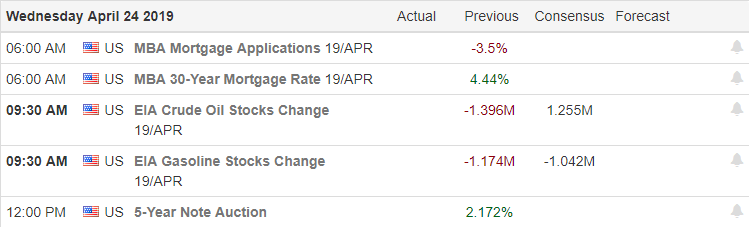

On the Calendar

We have a big on the Earnings Calendar with more than 200 companies reporting. Among the notable reports are CMG, TSLA, APD ALGN, T, ANTM, AVB, BA, SAM, CAT, CINF, CTXS, CS, CVI, DPZ, FB, GD, LRCX, MSFT, NDAQ, NSC, NOC, NVS, PYPL, SIRI, SAVE, SWK, TROW, TUP and V.

Action Plan

A record-breaking day yesterday with the bulls finding more than enough inspiration to push through resistance on the QQQ which is now up 32% from last Decembers low. The SPY and DIA are also within striking distance of new all-time high records that could be very easily achieved today assuming earnings continue to roll in above the lowered estimates. How interesting it is that earnings growth is expecting to decline, but as long as stocks continue to beat lowered estimates the market goes higher.

Yesterdays now New Home Sales number that surged well above estimates was a particular bright spot yesterday for the strength of the economy. Asian market struggled overnight closing mixed but mostly lower while Australia’s market reached out to 10-Year highs. This morning European are mixed but essentially flat as they also react to earnings reports. As I write this Dow futures point to a modest gap up while the other indexes are currently flat to slightly lower as we wait for another huge day of earnings reports. With both BA, CAT and T reporting before the bell the actual open of the Dow could be far different than it currently suggests. Expect significant price volatility this morning.

Trade Wisely,

Doug

Comments are closed.