Though big tech has seemed impervious to all bearish attacks of late, the rapid rise in bonds proved to be their kryptonite. Other worries such as debt ceiling deadlines, rising inflation, fading consumer confidence, and Chinese real estate impacts only added to the selling pressure creating severe technical damage to the index charts. As a result, the DIA, SPY, and QQQ charts now indicate bearish trends, and though bonds pulled back modestly, this morning risk remains high as their rally could soon continue. As a result, expect price volatility to remain very challenging in the days ahead.

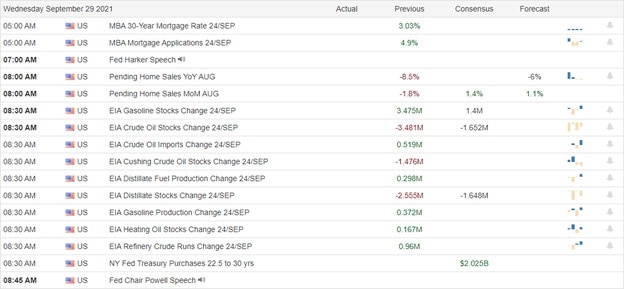

Overnight Asian markets traded mixed but mostly lower, with the NIKKEI plunging 2.12% as investors wait to see if Evergande can make Wednesday’s bond payments. European markets trade green across the board, working to recover some of yesterday’s selloff. Ahead of earnings, Pending Home Sales, Petroleum status numbers, and more Congressional testimony from Powell, U.S. futures point to a bullish open hoping to recover some of yesterday’s losses. So buckle up; it could be another wild price action day.

Economic Calendar

Earnings Calendar

On the mid-week earnings calendar, we have eight confirmed reports. Notable reports include CTAS, MLHR, JBL, NG, & WOR.

News & Technicals’

Jamie Dimon said the country’s largest lender has begun scenario-planning how a potential U.S. credit default would affect the repo and money markets, client contracts, and capital ratios. “This is like the third time we’ve had to do this, and it is a potentially catastrophic event,” he said. In a filing to the Hong Kong exchange on Wednesday, Evergrande said it would sell the 1.75 billion shares in Shengjing Bank to the Shenyang Shengjing Finance Investment Group at 5.70 yuan per share. Last week, the property firm already missed one key $83.5 million coupon payment on an offshore March 2022, $2 billion bonds. Markets are closely watching to see if the firm will meet its $47.5 million interest payment due Wednesday. Sen. Elizabeth Warren charged that Fed Chairman Jerome Powell had led an effort to weaken the nation’s banking system, and she would oppose his renomination. In remarks made during a Senate hearing, the Massachusetts Democrat cited several instances where she said the Powell Fed has watered down post-financial crisis bank regulations. U.S Treasuries retreated Wednesday morning, with the 10-year yield falling to 1.496% and the 30-year sliding to 2.04%.

The rapid rise in bonds created an ugly selloff in the tech sector that until now has seemed impervious to bearish activities of late. Moreover, the uncertainty of the debt ceiling battle in Congress likely added some additional energy to the bears in yesterday’s rout. Additionally, comments from Jerome Powel that warned inflationary pressures would continue into the near future didn’t hope the situation. The unfortunate consequence is the severe technical damage created in the index charts. As a result, we will have to keep a close eye on bond rates in the future. Fed operations have kept yields in check, but the Fed could lose control is a growing concern. Legendary investor Jeremy Grantham used the term “magnificent bubble” to describe the current market condition comparing to 1929 and 2000. So be very careful rushing in to buy the dip because yesterday may have signaled a fundamentally different market condition.

Trade Wisely,

Doug

Comments are closed.