With illegal boarders crossings reportedly rising to 4500 per day the President shocked the market yesterday afternoon with punitive tariff increases on Mexican goods. The tariffs will begin with a 5% increase on June 10th with an increase to 10% in July and 25% in October unless Mexico takes steps to stem the tide of illegal crossings.

The shock and uncertainty of this action have the futures pointing to a substantial gap down this morning that threatens to break some key price support levels. Raising this much uncertainty ahead of the weekend has the potential to create some panic among already battered traders and investors. Buckle up the road could be very bumpy ahead.

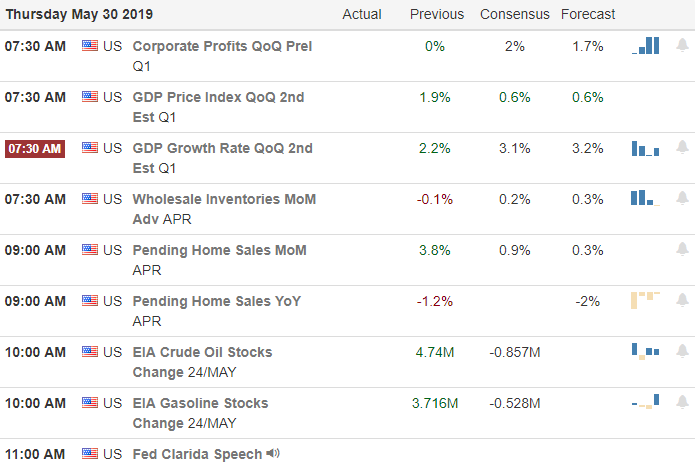

On the Calendar

A light day on the Earnings Calendar as we begin to wind down the second quarter earnings season. The only particularly notable report today is BIG coming out before the bell.

Action Plan

Yesterday’s choppy price action reflected the uncertainty the faces leaving behind more questions than answers. After the bell the President then surprised the everyone announcing he will raise tariffs on Mexico by June 10th if they don’t begin to stem the tide of illegal crossings that are overwhelming border enforcement. According to reports the US is currently holding over 80K illegals with approximately 4500 added each day. According to the Whitehouse the tariffs will be at 5% and increasing to 10% in July and 25% shortly after that if the problem persists.

This morning the futures are reacting strongly to the surprising news suggesting a gap down of more than 200 Dow points at the open. Grappling with the possible ramifications and uncertainty of it all has the potential to trigger a bit of panic selling if key supports fail with the weekend approaching. The best we can do is stay focused on the price action and disciplined to our rules, avoiding emotional decision making that often creates costly mistakes.

Trade wisely,

Doug

Comments are closed.