Preparation and discipline are vital at market highs.

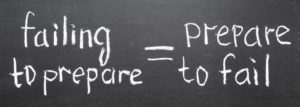

I believe preparation and discipline are integral to a trader’s success. As the market entertains new record highs, thoughtful preparation, and the discipline to stick to a plan become vital. Those who choose only to view the market through rose colored glasses will miss important price action clues. Traders that only see gloom and doom are equally incorrect as they will fail to take action when the possibility of gains present themselves.

I believe preparation and discipline are integral to a trader’s success. As the market entertains new record highs, thoughtful preparation, and the discipline to stick to a plan become vital. Those who choose only to view the market through rose colored glasses will miss important price action clues. Traders that only see gloom and doom are equally incorrect as they will fail to take action when the possibility of gains present themselves.

To be successful, a trader must set aside personal biases and realize that anything is possible. At or near market highs it is necessary to plan for and have the willingness to see the potential of price failures. It’s equally important to visualize the potential of bullish clues and have plans to capitalize on them if they occur. What we think should happen or attempting to predict what will happen next waste time and cloud the trader’s ability to plan objectively.

On the Calendar

The last Friday in May starts with two very important reports on the Economic Calendar. At 8:30 AM Eastern both Durable Goods Orders and GDP reports are released. At 10:00 AM the less impactful Consumer Sentiment numbers roll out. Durable Goods has been holding up quite well but today Wall Street number crunchers say we should expect a negative number today.

Of course, the GDP number is the biggy of the day and has the ability to move the market. The overall GDP number is expected to remain at 2.3 as a result of very weak consumer spending. There are only 14 companies on the Earnings Calendar today, and none of them should be very impactful to the overall market.

Action Plan

Friday is profit day, and ahead of a three-day weekend, it becomes even more important. In anticipation, I have been taking profits and trimming exposure to the market all week. There are several however that I plan to carry through the weekend unless something major changes today. Another factor to consider is that price support of the breakout still needs to be tested.

I will remain cautious until price action confirms support with buyers actively buying at this level. Obviously, if support happens to fail and the Bears would likely be emboldened to take control. I for one want to keep a very watchful eye on price action, and I plan to do so largely from the sideline to protect my capital. I won’t completely rule out adding new positions today, but it’s highly unlikely.

Trade Wisely, and have a fantastic weekend!

[button_2 color=”green” align=”center” href=”https://youtu.be/VryEcgUfPMc”]Morning Market Prep Video[/button_2]Doug

Comments are closed.