The extraordinary rally is a welcome relief but not one must wonder if the exuberance of the potential interest rate cut is now overextended. One thing for sure is that we have moved a long way in a very short period of time and a little pullback would not be out of the question. Be careful not to chase. Asian market closed mixed but mostly modestly lower overnight. European markets are currently green across the board as they await an ECB rate decision.

With the DIA, SPY and QQQ back above their respective 200-day averages repairing some of the technical damage in the charts but that will only be true if the bulls can prove to hold them as support. We have the big Employment Situation number Friday morning so don’t rule out the possibility of light and choppy price action after the morning rush as we wait. Remember some profit taking could begin at any time with the Dow having risen more than 700 points in just two days.

On the Calendar

We have fewer than 30 companies reporting quarterly results today. Notable reports include OllI & SIG.

Action Plan

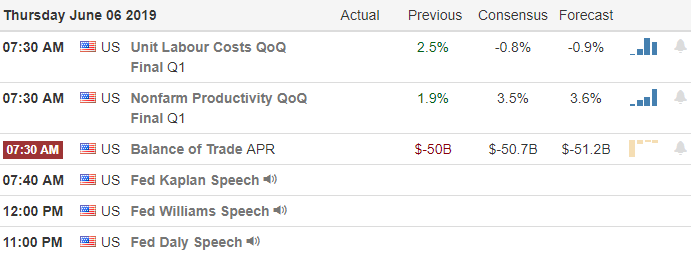

After two big days of rally on the hope of an interest rate cut futures are once pointing to a modestly bullish gap up open. However that could certainly increase or decline as we move toward the open with International Trade, Jobless Claims, as well as Productivity & Cost numbers at 8:30 AM Eastern. It will be interesting to see if the bull can maintain their enthusiasm after Goldman’s warning that the market has overpriced the possible Fed cuts.

This morning we are also waiting on an ECB rate decision. A surprise cut or increase across the pond has in the past moved US markets significantly in the past so keep an eye on those early morning futures. Although the indexes are still well below their 50-day moving averages the DIA, SPY and QQQ have pop above their 200-averages reliving some of the technical damage. If some profit takers do soon come in holding above these key averages will be very important. Remember we have the Employment Situation number Friday morning so after the morning rush don’t be surprised to light and choppy price action as wait.

Trade Wisely,

Doug

Comments are closed.