Another big day of buying the relief rally set new record highs in the SPY and QQQ on Monday. In just 3-trading days, the SP-500 rallied 110 points, and the Nasdaq surged 519 points, a massive of 3.60%. With the U.S. House poised to deliver two more massive deficit spending bills with reclaimed bullish trends, it seems the sky is the limit for how high the indexes can go. Debit, consumer sentiment, inflation, and rising pandemic impacts seem to have no impact on the willingness to push prices higher. So stay with the trend, and let’s continue to party as long as it lasts.

Overnight Asian markets continued to recover, with the Hong Kong leaping a whopping 2.46%, spurred on by the Pfizer vaccine approval. However, European markets are not so rambunctious this morning, mainly trading lower but with modest losses. That said, U.S. futures indicate a higher open and more new records as tech continues to reach for the stars. Don’t rule out the possibility of profit-taking, and be careful not to chase already extended stocks.

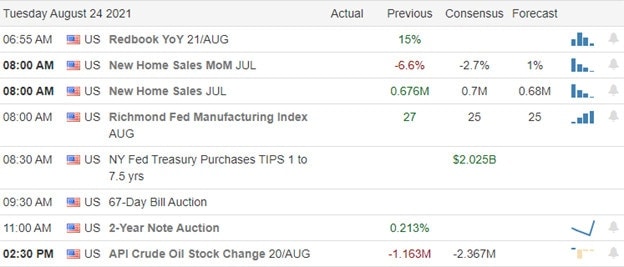

Economic Calendar

Earnings Calendar

This Tuesday, we have 33 companies listed on the earnings calendar, with several unconfirmed reports. Notable reports include BBY, AAP, INTU, MDT, JWN, PDD, TOL, & URBN.

News & Technicals’

The U.S. House has delayed voting to advance the massive spending plans as centrists pushed Speaker Nancy Pelosi to vote on the Senate-passed infrastructure bill before moving on the 3.5 trillion packages. The natural gas pipeline between Europe and Russia has recently slowed the delivery, raising questions about the potential cause and implications for global gas markets. Angela Merkel says further sanctions may be imposed if Moscow is using the gas supply as a weapon. Leaders will meet virtually for an emergency G7 meeting with countries pushing President Biden to extend the Aug. 31st deadline. However, Afghanistan delivered a redline to the U.S., saying it will not accept and extension raising tensions as efforts to get Americans and those who supported our efforts out of the country. Treasury yields rose slightly this morning, with the 10-year increase to 1.268% and the 30-year trading up to 1.888%.

The strong bounce that began on Friday surged to new record highs in the SPY and QQQ led by big tech giants. Microsoft, Google, and NVDA printed new record prices joined by others that rallied strongly yesterday. CNBC said the FDA’s full approval of the PFE vaccine was the impetus for the bullish surge, but most of the enthusiasm was tech-based. That said, there are still a significant number of stocks below their 200-day moving averages, creating a wide divide between the have’s and have not’s. The overall SP-500 P/E ratio is more than 94% above its 10-year historical average, and one has to wonder how much higher it could go. Of course, the U.S. House is moving forward with two huge spending bills, and we all know how much the market seems to love deficit spending. So stay with the trend but stay on guard should the bears find another reason to attack.

Trade Wisely,

Doug

Comments are closed.