New Record Highs in the Tech Sector.

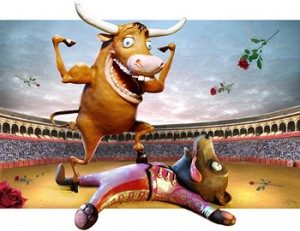

With an impressive display of strength, the Bulls managed to make new record highs in the tech sector once again. It’s as if North Korea disappeared and the devastation on the southern coast never happened. The Bulls are large and in charge as we begin September. Futures are suggesting yet another gap up, and the VIX is once again testing historical lows. As we say all the time, “Trade with the trend until the trend ends” and the trend except for the IWM is up. With a gap at or near new market highs always watch for possible whipsaw price action. I’m not saying it is, but it’s the perfect place to set a bull trap much like the gap down on the 29th turned into a Bear trap.

With an impressive display of strength, the Bulls managed to make new record highs in the tech sector once again. It’s as if North Korea disappeared and the devastation on the southern coast never happened. The Bulls are large and in charge as we begin September. Futures are suggesting yet another gap up, and the VIX is once again testing historical lows. As we say all the time, “Trade with the trend until the trend ends” and the trend except for the IWM is up. With a gap at or near new market highs always watch for possible whipsaw price action. I’m not saying it is, but it’s the perfect place to set a bull trap much like the gap down on the 29th turned into a Bear trap.

On the Calendar

The Friday Economic Calendar kicks off with the granddaddy report of the month. Before the market opens at 8:30 AM Eastern the Employment Situation Report is released. Forecasters are looking for this number to cool off to 180K vs. the 231K reading last month. At 9:45 we get the PMI Mfg Index which last month was 53.3, but there seems to be no forecast for this month. At 10:00 AM the ISM Mfg numbers is the other big number today that could move the market. The ISM August consensus is calling for continued strength at 56.6 vs. 56.3 in July. Construction Spending and Consumer Sentiment is also at 10:00 AM today. Construction Spending is expected to bounce higher today. The consensus of Consumer Sentiment suggests it likely diminishes slightly to a 97.4 reading.

On the Earnings Calendar, there are less than 20 companies expected to report today. I would expect none of them to be market moving, but please continue to check your holdings as part of your morning prep.

Action Plan

With three days of amazing bullish strength, the QQQ set a new record high yesterday with buying right into the close. The SPY was also very impressive however it continues to remain under price resistance although very near new highs. The DIA decided to take a siesta yesterday after gapping up choosing to just lounge around in a small chop zone. And although the IWM still has a lot of recovering to do it also pushed up strongly to test resistance levels.

With the Bulls continuing to push on the futures, it is pointing to a gap up of more than 50 Dow points. Personally, I don’t want to chase the gap at or near market highs. I will focus on the price action after the open looking for follow through buying before deciding to add new positions. Because this is Friday and we have had an amazing reversal I will be planning to take some profits today before the weekend. With the Bull running hard the VIX has dropped back into the zone of historic lows. When there is no fear, big moves are possible but also know they can also be very volatile.

[button_2 color=”green” align=”center” href=”https://youtu.be/SymJxUe_cZk”]Morning Market Prep Video[/button_2]Trade Wisely,

Doug

Comments are closed.