U.S. stock futures declined on Thursday, following the Nasdaq Composite’s milestone of closing above the 20,000 mark for the first time. The S&P 500 saw a gain of 0.8%, while the Dow Jones Industrial Average lagged, dropping by approximately 99 points, or 0.2%. Hackett noted that current market expectations are high, with valuations at their peak since the tech bubble. Despite supportive seasonal and technical factors through year-end, investors are expected to be more selective next year, carefully weighing risks and rewards. On the economic front, the producer price index report for November anticipated to show a 0.2% monthly increase, and weekly jobless claims are set to be released on Thursday morning.

European markets experienced a slight dip on Thursday morning as investors awaited the European Central Bank’s (ECB) final monetary policy decision of the year. The Stoxx Europe 600 index edged down by less than 0.1%, while the euro saw a notable increase of 0.7% against the Swiss franc following an unexpected 50-basis-point rate cut by the Swiss National Bank. Analysts surveyed by Bloomberg anticipate that the ECB will reduce its policy rate by 25 basis points for the fourth time this year. Additionally, the ECB is expected to release its quarterly macroeconomic projections, providing insights into future growth and inflation trends.

Asia-Pacific markets mostly saw gains on Wednesday, buoyed by positive momentum from Wall Street. Investors in the region reacted to Australia’s latest jobs data, which revealed an 8-month low unemployment rate of 3.9% for November. Despite this, Australia’s S&P/ASX 200 dipped by 0.28%. In Japan, the Nikkei 225 and Topix indices rose by 1.21% and 0.86%, respectively. South Korea’s President Yoon Suk Yeol, addressing public pressure, stated he would not resign, coinciding with a 1.62% rise in the Kospi index and a 1.1% increase in the Kosdaq. Meanwhile, China’s CSI 300 climbed 0.99%, and Hong Kong’s Hang Seng index advanced by 1.28%.

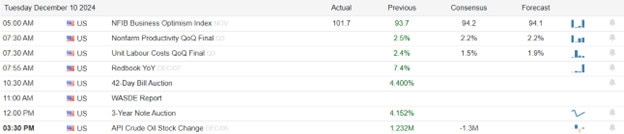

Economic Calendar

Earnings Calendar

Notable reports for Thursday before the bell include CEIN. After the bell reports include AVGO, COST, & RH.

News & Technicals’

President Joe Biden announced the commutation of sentences for nearly 1,500 offenders and the pardoning of 39 others, marking the largest number of clemencies granted in a single day, according to the White House. In a statement, Biden emphasized America’s foundation on the promise of possibility and second chances. The White House noted that Biden has issued more sentence commutations at this point in his presidency than any recent predecessors in their first terms. Biden hinted at further actions, stating that his administration would continue to review clemency petitions and take additional steps in the coming weeks.

Oil prices edged higher for the fourth consecutive day amid potential tighter restrictions on Russian and Iranian oil flows. Brent crude hovered around $74 per barrel, having climbed over 3% in the past three sessions. U.S. Treasury Secretary Janet Yellen suggested that low oil prices might enable further sanctions on Russia, while Donald Trump’s national security adviser nominee indicated a strategy of maximum pressure on Iran. Despite these developments, the International Energy Agency (IEA) warned of a potential oil supply glut next year, contrasting with the U.S. Energy Information Administration’s (EIA) forecast of balanced markets. This comes even as OPEC+ has decided to postpone increasing output.

China reaffirmed its recent policy adjustments and emphasized plans to stimulate growth during a high-level economic planning meeting that concluded on Thursday, as reported by state media. Using language reminiscent of the 2008 global financial crisis, Beijing highlighted an increased urgency to bolster its struggling economy and brace for a potential trade war with the U.S., with Donald Trump returning to the White House. Since late September, Chinese officials have intensified stimulus efforts, but recent economic data shows these measures have not been enough to counter ongoing deflationary pressures. This has raised investor expectations that Beijing will further enhance its stimulus initiatives to revive growth. Notably, the country’s consumer price inflation dropped to a five-month low in November.

Adobe’s stock dropped by 8% following the release of its revenue estimates for the fiscal first quarter, which fell short of expectations. The company projected revenues between $5.63 billion and $5.68 billion, below the consensus estimate of $5.73 billion as reported by LSEG. Despite this, Adobe’s adjusted earnings per share and revenue for the previous quarter exceeded analysts’ forecasts, highlighting a mixed financial outlook for the company.

The market chose to celebrate the rising inflation in the CPI with Nasdaq Composite’s Milestone of 20,000 as big tech surged higher. Keep in mind that today we have more inflation data with the PPI report as well as jobless claims. Plan your risk carefully.

Trade Wisely,

Doug

Comments are closed.