The big swing in yesterday’s indexes left more questions than answers with significant overhead resistance and tremendous risk for those jumping in should the lows be retested. There is now talk of four rate increases this year, yet the institutions continue are putting out a steady stream of hype and predictions that the market should be higher. Stick to your trading rules and stay focused on price action. Market moves like this create a loss of emotional decision-making and enormous price swings that can damage the retail trader’s accounts. Work to avoid overtrading and getting caught up in the drama.

Overnight Asian markets traded lower with worries of inflation on the mind of investors. However, this morning, European markets are in rebound mode, seeing nothing but green across the board as they wait on the U.S. inflation data. With a light day of earnings and Powell’s testimony in the Senate just around the corner, U.S Futures point to a gap up open. Keep a close eye on those overhead resistance levels for entrenched bears.

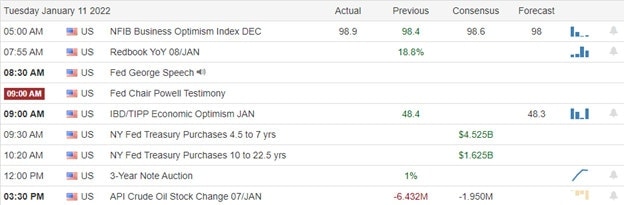

Economic Calendar

Earnings Calendar

We have nine companies listed on the Tuesday earnings calendar and with just four confirmed reports. Notable reports include ACI and SNX.

News & Technicals’

Slapping sanctions on Russia may not help resolve tensions with the U.S. over Ukraine, two experts said Tuesday. “Sanctions don’t work on Russia,” said Tony Brenton, a former British ambassador to Russia. “Russia just becomes even more obdurate.” Angela Stent of Georgetown University said many sanctions have been explicitly discussed in the U.S., but “that doesn’t seem to have deterred Russia at all.” Federal Reserve Vice Chairman Richard Clarida said Monday he would be leaving his post-Friday, shortly before his term expired. The resignation comes following more questions into stock fund trades for Clarida in February 2020. “The two doses, they’re not enough for omicron,” Pfizer CEO Albert Bourla said. Bourla said the two-dose vaccine does not provide robust protection against infection, and its ability to prevent hospitalization has also declined. Bourla said third shots provide good protection against death and “decent” protection against hospitalization. According to Mortgage News Daily, the average rate on the popular 30-year mortgage hit 3.64% on Monday morning, after rising sharply last week. For the median-priced home, currently about $350,000, buyers putting down 20% will now see a monthly payment of $125 higher than they would have just three weeks ago. Stocks of the public homebuilders are all down in 2022. Treasury Yields declined in early Tuesday trading, with the 10-year dipping to 1.7569% and the 30-year declining to 2.0766%.

Yesterday’s massive sell-off and rebound left more questions than answers in the index charts. Though the end-of-day surge will likely inspire the buy-the-dip buyers to rush back in, caution should be exercised as we approach the significant price resistance levels above. However, big institutions seem to be singing off the same sheet of music, suggesting the sell-off is a significant market mispricing. So, what’s a trader to do? Remember Price is King! Stay focused on price and your trading plan and work to avoid the emotional reaction created by big price swings and all the talking head hot air. Follow your trading plan making sure the risk you take is acceptable at all times, or emotion will take over your decision-making. Today Powell will be testifying in the Senate as they move forward with his confirmation. Expect price volatility to remain high, and remember we have inflation data coming our way first thing Wednesday morning.

Trade Wisely,

Doug

Comments are closed.