The hope for a follow-up bullish move after Monday’s rally fizzled quickly as the bears went back to work as uncertainty about the next move of the FOMC weighs. Though the wait is nearly over, we must first deal with Existing Home Sales and the Petroleum Status report. Plan for volatility at the rate increase announcement. However, the real fireworks could begin during the press conference, where the market hopes to hear the committee will pivot, backing off on their inflation fight. Plan for big price swings with the market hanging on each word of Powell’s comments.

Asian markets struggled overnight after the Putin speech that shot up oil prices by nearly 3%. However, Europe is trading modestly green across the board, with eyes on the FOMC after deciding to nationalize Uniper energy. U.S. futures are trying to bounce ahead of housing and oil data again, with the big show beginning at 2 PM eastern. This afternoon, plan for some big price swings during the chairman’s press conference.

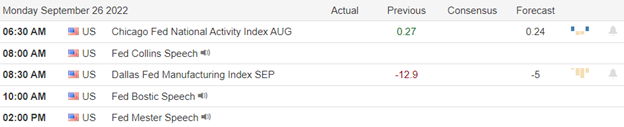

Economic Calendar

Earnings Calendar

We have a bit more activity on the earning calendar today, focusing on builders after the bell. Notable reports include GIS, FUL, KBH, LEN, SCS & TCOM.

News & Technicals’

President Putin has ordered the partial mobilization of the Russian population, including ordering military reservists into active service and a boost to weapons production. In a pre-recorded announcement, Putin said the West “wants to destroy our country.” He claimed the West had tried to “turn Ukraine’s people into cannon fodder,” in comments translated by Reuters. Wells Fargo makes a case for a 150 basis point hike at today’s FOMC meeting. Michael Schumacher suggests the Fed is raising rates too slowly and should seriously consider a 150-point hike moving it closer to the end-of-year target of plus 4%. Germany nationalizes energy giant Uniper, with the state now buying out the 56% stake of Finland’s Fortum for 500 million euros. The British pound hit a fresh 37-year low against the dollar last week amid fears for the economy’s health, as the country’s cost-of-living crisis begins to weigh on activity. The Monetary Policy Committee will announce its latest decision on Thursday, with analysts divided over whether to expect a hike to interest rates of 50 or 75 basis points. Inflation expectations have shifted in light of the announcement of new energy cost measures from new Prime Minister Liz Truss’s government.

The Asian Development Bank now sees growth among emerging Asian economies of 4.3% in 2022 and 4.9% in 2023. The ADB expects the rest of developing Asia, excluding China, to grow by 5.3% in both 2022 and 2023, while it now expects China to grow by 3.3% in 2022, lower than revised forecasts released in July. The report said this would be the first time in more than three decades that the rest of developing Asia will grow faster than China. Treasury yields dipped slightly early Wednesday, with the 12-month at 3.97%, the 2-year at 3.95%, the 5-year at 3.72%, the 10-year at 3,53%, and the 30-year at 3.54%.

Monday’s rally raised to begin a relief rally quickly reversed Tuesday morning with the bears returning to work, pushing the index to a slightly lower low before bouncing again in the late afternoon session. The wide-ranging chop is undoubtedly frustrating but not that big of a surprise considering the gravity of today’s Fed decision. An increase of 75 basis points is largely expected, but the market hopes to see signs that the committee will soon back off its aggressive stance and capitulate on inflation. As a result, expect price volatility at the 2 PM eastern decision, but the fundamental uncertainty could happen during Powell’s press conference. However, before that, we will have to deal with an Existing Home Sales report that consensus expects to decline and a Petroleum status report. Experienced day traders will likely have the upper hand in a day where just about anything is possible. Buckle up the fun is about to begin!

Trade Wisely,

Doug

Comments are closed.