What a massive reversal of market sentiment as the bulls find even more energy to extend this incredible relief rally. Is this irrational exuberance? Perhaps, but it would be very unwise to try and fight it or predict when it will be over. Remember the market can remain irrational much longer than you can remain liquid if you try to fight the bull.

Asian markets closed higher on better than expected trade surplus numbers. European markets are bullish but subdued ahead of UK economic data this morning. US Futures point to more than a 100 point Dow gap after avoiding tariff increases with Mexico and news of a huge merger between United Technologies and Raytheon creating the 2nd largest defense company in the world. If your long this morning remember gap are gifts taking profits or scaling. Never allow greed to get in the way of taking a profit. If you miss this rally then for goodness sake don’t chase it this late in the move with the fear of missing out. Stay disciplined and exercise patience waiting for the next entry.

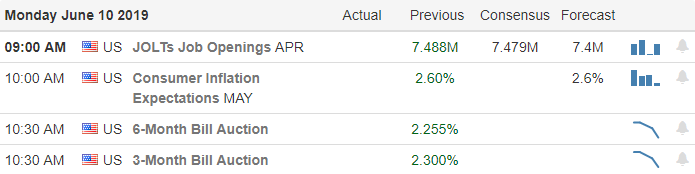

On the Calendar

On the Earnings Calendar we have about 30 companies reporting their quarterly results today with none that are particularly notable unless you happen to own one of them. Make sure always to check earnings dates a part of your market preparation.

Action Plan

A deal with Mexico to avert tariffs, a larger than expected China trade surplus and a merger or United Technologies and Raytheon continue to inspire the bulls higher this morning. US futures are suggesting more than a 100 point gap in an already very extended relief rally even as the president expresses the willingness to add 300 billion in Chinese tariffs. Is this over-exuberance and a bit nonsensical? Maybe, but as a retail trader it’s unwise to fight the bull or try to predict its conclusion because they can run right over you.

While I feel this relief rally is very extended and this mornings gap has the potential to end as a pop an drop I must stay focused on the price action trading what is not what I think it should be. As Jessie Livermore once said, “The Market is never wrong but opinions often are”. Stay disciplined to your rules taking profits or scaling out not allowing greed to interfere with taking profits. Remember gaps are gifts! If you have missed this rally then for goodness sake don’t chase it with the fear of missing out. Be patient and wait for the next entry based on good price action and analysis rather than emotion.

Trade Wisely,

Doug

Comments are closed.