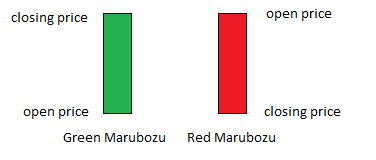

Simplicity. It’s a lovely word and a very calming concept. After studying lots of complex candlestick patterns, it’s always nice to get back to the basics. Much like the Doji, the Marubozu candlestick pattern is a one-candle, easy-to-spot signal with a very clear meaning. It comes in both a bearish (red or black) and a bullish (green or white) form, and it commands attention with its long and sturdy shape. To learn more about how Marubozu candlesticks form, why they form, and what they can tell you about the current state of the market, please scroll down.

Marubozu Candlestick Pattern

Formation

It doesn’t get any simpler than this! Even the Doji, that tiny little sprite, isn’t easier to spot than the Marubozu. If you think you’ve found a Marubozu candlestick pattern, look for the following criteria:

First, the single candle involved in the signal should have a long real body. Second, there must not be an upper or a lower wick (a.k.a., a shadow).

That’s all there is to it! You’re looking for a big block without any extraneous limbs or extensions.

The signal can be white/green or black/red, and it can appear anywhere on the chart. A white/green Marubozu moves upward and is very bullish, and a black/red Marubozu moves downward and is very bearish. The longer the candle is, the more dramatic the jump in price has been (whether it jumped up or down).

Sometimes you will see these signals called simply White Marubozu and Black Marubozu.

Meaning

The word marubozu means “bald head” or “shaved head” in Japanese, and this is reflected in the candlestick’s lack of wicks. When you see a Marubozu candlestick, the fact that there are no wicks tells you that the session opened at the high price of the day and closed at the low price of the day. In a bullish Marubozu, the buyers maintained control of the price throughout the day, from the opening bell to the close. In a bearish Marubozu, the sellers controlled the price from the opening bell to the close.

Depending on where a Marubozu is located and what color it is, you can make predictions:

- If a White Marubozu occurs at the end of an uptrend, a continuation is likely.

- If a White Marubozu occurs at the end of a downtrend, a reversal is likely.

- If a Black Marubozu occurs at the end of a downtrend, a continuation is likely.

- If a Black Marubozu occurs at the end of an uptrend, a reversal is likely.

However, because these conjectures fail to provide 100% certainty, it is always best to confirm your suspicions by watching the candles that appear after the Marubozu. If the next few candles confirm your forecast (or if you spot another supportive candlestick pattern), feel free to move forward with confidence.

Good luck!

If you’re interested in mastering some simple but effective swing trading strategies, check out Hit & Run Candlesticks. Our methods are simple, yet powerful. We look for stocks positioned to make an unusually large percentage move, using high percentage profit patterns as well as powerful Japanese Candlesticks. Our services include coaching with experienced swing traders, training clinics, and daily trading ideas. To sign up for a membership, please click here.

Comments are closed.