With record highs across the board, the market celebrated strong earning and the administration change in the Whitehouse with the promise of more stimulus on the way. Though there is a chorus of investment banks suggesting higher market highs are on the way, some are suggesting a euphoric market bubble has formed. Who’s right? Your guess is as good as mine. The best we can do is plan carefully, avoid overtrading and stay with the trend as long as it lasts, but always remembering it will one day end.

Overnight Asian markets traded mostly higher, and European markets edge higher, keeping an eye on earnings data. U.S. futures point to a positive open with a busy day of earnings, economic and political news setting the stage for possible volatile price action.

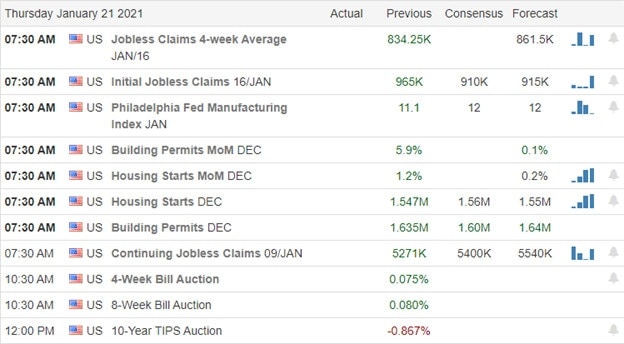

Economic Calendar

Earnings Calendar

On the Thursday earnings calendar, we have the biggest day of the week, with 43 companies on the list and 33 confirmed reports. Notable reports include INTC, BKR, CTXS, CSX, FITB, IBM, ISRG, KEY, MTB, PPG, STX, SIVB, TAL, TRV, & UNP.

News and Technicals’

The market celebrated the strong earnings and President Biden’s inauguration, setting new record highs set in all four indexes. He signed 17 executive orders yesterday and plans another 10 today addressing pandemic issues. Dr. Fauci says the U.S. will remain a WHO member and join the global Covid vaccine plan. Stock futures are once again edging higher this morning, with Godman, Morgan Stanley, and JPMorgan singing in chorus for higher valuation to come. However, not everyone feels that way, with Jeremy Grantham saying the market is in a bubble with very seldom seen euphoria levels. As a technical trader, all I can do is stay with the bullish trend until as long as it lasts, carefully planning risk, making sure to follow my trading plan rules, and avoiding overtrading with the existing extending market condition.

Setting new record highs across the board makes it easy to see that the bulls are large and in charge of the market trends. However, it is also easy to see a very extended market condition that poses a significant risk of a steep selloff that should cause the market to stumble. Take caution in trading stocks that extend from price supports. We have a big day earnings and economic data and a boatload of political news that has the potential to create significant price volatility. Plan carefully.

Trade Wisley,

Doug

Comments are closed.