Less Aggressive FOMC

Did anyone notice a sparkle in Jerome Powell’s eye and check for reindeer on the roof as he delivered the huge gift of a less aggressive FOMC? Moments, after he began to speak the gates opened and the bulls unleashed a huge wave of buying that quickly cut through pesky price resistance levels. Currently, the US Futures are pointing to a modest gap down open this morning, but a little profit-taking after such a huge one-day bull run should not be a big surprise.

Did anyone notice a sparkle in Jerome Powell’s eye and check for reindeer on the roof as he delivered the huge gift of a less aggressive FOMC? Moments, after he began to speak the gates opened and the bulls unleashed a huge wave of buying that quickly cut through pesky price resistance levels. Currently, the US Futures are pointing to a modest gap down open this morning, but a little profit-taking after such a huge one-day bull run should not be a big surprise.

Keep a close eye on the price action because the sheer momentum of yesterday’s move could inspire the bulls to continue pushing forward into the weekend. Now the market will focus it’s attention on the G20 meeting and hoping it will help deliver the bigger gift; progress on the US / China trade negotiations. With the harsh rhetoric and threats lobed back an forth between the two leaders that might be a big ask. Stay focused on price action the clues will be there.

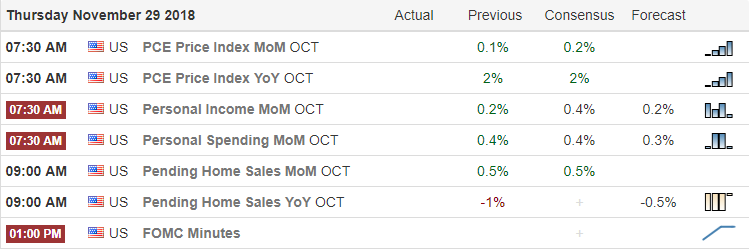

On the Calendar

On the Earnings Calendar, we have our biggest day of the week with 54 companies expected the report to keep us on our toes.

Action Plan

The Fed Chairman Jerome Powell triggered a bullish stampede yesterday indicating a less aggressive

FOMC than the market had expected. The burst of buying cut through resistance levels in the indexes as if a pressure value suddenly opened. After such a huge move its not unreasonable to think there will be some profit taking and according to this morning’s futures we should see a modest gap down.

If we could now get a trade agreement between the US and China, Santa’s could come to town in a newly turbocharged sleigh! Unfortunately, it’s not all sunshine and roses this morning with the news of a police raid on Deutsche Bank with allegations of money laundering. After the morning pullback, keep a close eye on the price action, yesterday’s huge momentum could keep the Bulls pushing forward into the end of the week.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/zjP0ZPa0XR8″]Morning Market Prep Video[/button_2]

Comments are closed.