Although U.S. finished mixed lacking momentum, on Thursday, China’s import numbers saw a significant 8.4% increase in April, surpassing the 4.8% year-on-year growth predicted by a Reuters survey. Export figures also showed a positive trend, with a 1.5% year-on-year increase in April, measured in U.S. dollar terms, which was in line with market anticipations. Following the release of this data, the CSI 300 index of Mainland China witnessed a 0.95% rise, building on an earlier 0.2% increase at market opening, and ultimately closing at a value of 3,664.56. Meanwhile, Hong Kong’s Hang Seng index observed a 1.16% climb. In a separate economic indicator, Japan’s real wages recorded a 2.5% year-on-year decrease in March, continuing a downward trend for the 24th consecutive month.

European markets started the day mixed on Thursday morning amidst a week filled with earnings reports, causing a dip in the recent upward trend. The Stoxx 600 index saw a marginal decrease of 0.16% at 10:30 a.m. London time, breaking a streak of four sessions of gains. Industry performance was varied, with the automotive sector dropping by 1.3%, while oil and gas equities edged up by 0.5%.

U.S. stock futures start the day modestly lower as the upward drive on Wall Street diminished with interest rates slightly higher. The futures associated with the Dow Jones Industrial Average decreased by 69 points, equivalent to a 0.2% drop. Futures of the S&P 500 also fell by 0.2%, and those of the Nasdaq 100 retracted roughly 0.3%. Concurrently, yields on the benchmark 10-year Treasury note surged past the pivotal 4.5% threshold. Yields on the 2-year note witnessed a rise as well.

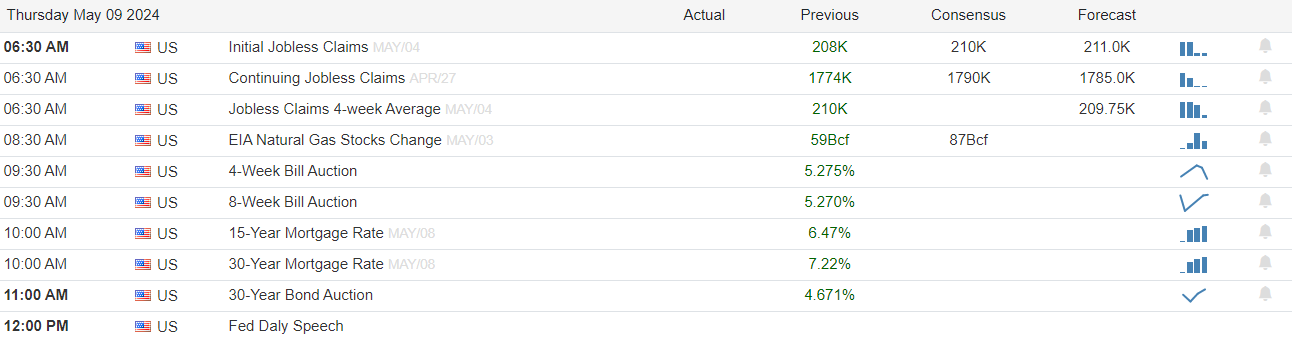

Economic Calendar

Earnings Calendar

Notable reports for Thursday before the bell include ALGM, ALE, FOLD, BERY, BIGC, BN, CSIQ, CARS, CRNC, CEVA, CRL, CWEN, CCOI, CEG, EDR, EVRG, RACE, FA, FVRR, GDRX, HAE, HBI, HGV, HIMX, H, IBP, NTLA, IRWD, JBI, DUNT, lSPD, MSGE, MPW, NABL, NTCT, NXST, NOMD, PZZA, PAR, PLNT, PLTK, PRVA, RBLX, SBH, SN, SIX, SPB, STVN, TPR, TSEM, USFD, VTRS, WRBY, WBD, WMG, & YETI. After the bell include AKAM, ALRM, COLD, AMN, AMPL, AAOI, ARLO, ARRY, ARWR, BW, BLNK, BE, CARG, CHUY, COLL, DIOD, DBX, EVCM, EVH, EXFY, FNKO, GEN, G, GDOT, GH, HRB, HCAT, INDI, FROG, LGF.A, MARA, MERC, MTD, NVTS, PACB, PGNY, RXT, SVV, SSP, SOUN, SG, SYNA, TTGT, SKIN, TREX, U, VCTR, WEST, XENE, YELP, & ZIP..

News & Technicals’

Arm Holdings unveiled its fourth-quarter earnings on Wednesday, reporting a robust 47% increase in revenue year-over-year, reaching $928 million. Despite this impressive growth, the company’s financial outlook for the fiscal year 2025 did not meet investor expectations. Arm projected its annual revenue to be in the range of $3.8 billion to $4.1 billion, which fell short of the $3.99 billion forecasted by analysts, as per LSEG data. This conservative guidance has led to a lukewarm response from the investment community.

The Bank of England is anticipated to maintain the current interest rates at its upcoming Thursday meeting. Market traders are poised to scrutinize Governor Andrew Bailey’s statement for any nuanced insights. With U.K. headline inflation predicted to decline sharply in April, there is mounting pressure on the BOE to initiate rate reductions to bolster the faltering economy. This development is in contrast to the trajectory of Europe’s central banks, which are diverging from the Federal Reserve’s policy. Market expectations are leaning towards rate cuts post-summer, while some economists speculate that there may be no rate cuts at all.

In the European Union, a strategic period of decision-making is underway as diplomats deliberate over future leadership for its three principal institutions: the European Commission, the European Council, and the European Parliament. From June 6 to 9, citizens from the 27 EU member states will cast their votes to elect new representatives for the European Parliament. Following the elections, the most influential EU positions, which are appointed rather than directly elected, will be allocated. These roles are pivotal in shaping central policies, with the decisions made in Brussels affecting the lives of approximately 450 million individuals throughout the union.

Country Garden Holdings Co., a Chinese property developer, has announced that it will not be able to fulfill the initial payment deadlines for the interest on two of its domestic bonds. In response, a state-backed guarantor is set to intervene, marking a significant moment for a governmental initiative aimed at supporting the real estate sector’s financial stability. According to recent filings, the company’s domestic division is unable to complete the interest payments for its bonds with 3.95% and 3.8% coupon rates by the May 9 deadline. These bonds are underwritten by the China Bond Insurance Co., a state enterprise that plays a central role in a 2022-launched scheme designed to prevent cash flow difficulties for private developers.

Although the Dow had a good day on Wednesday all the indexes were lacking in momentum, as volume was noticeably weak. Perhaps the huge number of earnings or the weekly jobs numbers can provide some inspiration to the bulls or bears today. Plan your risk carefully and continue to watch for substantial point moves.

Trade Wisely,

Doug

Comments are closed.