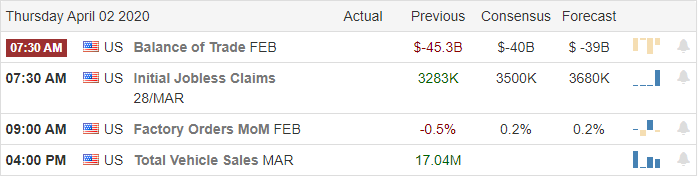

After a nasty day of selling and ahead of what is likely to be a historic jobless number, US futures are trying to put on a brave face pointing to a substantial overnight gap up. Perhaps its, because the number has been baked into the current prices or maybe, we’re just trying to bury our head in the sand a pretend it doesn’t matter. I could be wrong, but having 4 to 5 million unemployed in a consumer-based economy is an impact that will eventually be impossible to ignore.

Asian markets closed mixed, but mostly higher overnight and European markets indicate modest gains across the board this morning. Ahead of the earnings and economic data oil prices are up 10%, and futures suggest a recovery of about 1/3 of yesterday’s selloff. Think and plan carefully if you decide to risk your hard-earned money in this wild and emotionally irrational market.

Economic Calendar

Earnings Calendar

We have 44 companies reporting earnings today. Notable reports include WBA, CHWY, KMX & PLAY.

Top Stories

US Treasury yields are falling this morning in reaction to the pending jobless claims number that some predict could top 4 million. Sadly economists expect millions more soon as the virus wreaks havoc on business. There are, however, some bright spots on the jobs front with grocery stores and essential supply outlets continuing to hire to keep up with demand.

The President is considering halting domestic flights between coronavirus hot spots in an attempt to slow the spread of the virus.

It could be a very challenging 2nd earnings season with companies delaying reports and analysts withdrawing forecasts amid the virus chaos.

Technically Speaking

After an ugly day of selling on Wednesday, US futures put on a brave face pointing to a considerable gap up as the irrational volatility of this market continues. For some reason, the futures are trying to convince everyone that historic unemployment isn’t a big deal. However, with infection numbers surpassing 215,000 and continuing to rise, economists expect this number to continue to increase dramatically. Attempting to ignore the massive impacts of unemployment in a consumer-based economy shows how dangerously irrational and manipulated the market can be. Think carefully before reacting emotionally and chasing these wild morning reversals.

Sadly the QQQ was unable to hold its 500-day average during yesterday’s selloff, but this morning’s bullishness ahead of the jobless number suggests it could recover it at the open. The DIA daily 50-average has now crossed down both the 200 & 500-day averages as this outbreak continues to create technically damage to the index charts. With a big data dump this morning and the Friday Employment Stiucation number ahead, traders should prepare for just about anything. Big intra-day news-driven reversal and whipsaws are possible to plan your risk carefully should you choose to risk your hard-earned capital amidst such market uncertainty.

Trade Wisely,

Doug

Comments are closed.