Futures are flat this morning as we wait on the next Jobless number as the virus impacts create the worst unemployment situation in the nation’s history. Heading into a 3-day Easter weekend with a CPI report, possible oil production cuts on Friday, and infection rates continuing to grow, anything is possible by Monday morning. Plan your risk carefully as we head into the weekend.

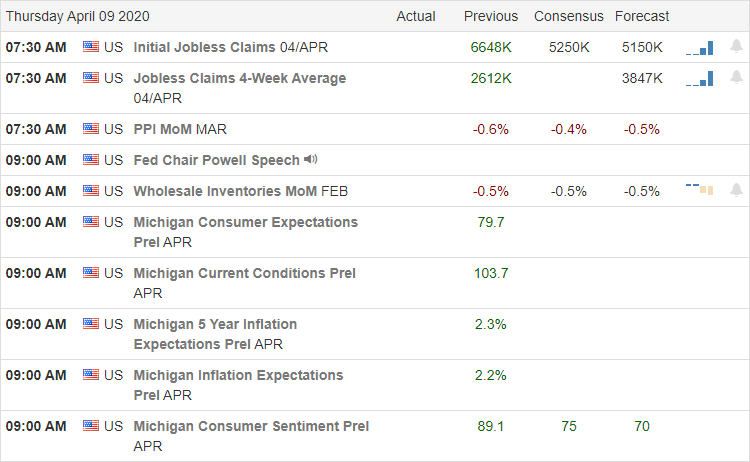

Asian markets closed mixed but mostly modestly higher overnight. European markets are trading slightly higher this morning, and the US Futures point to flat open ahead of the weekly jobless claims with estimates that another 5 million Americans are out of work. We will also hear from Jerome Powell and get a reading on Consumer Sentiment, which may see a sharp decline.

Economic Calendar

Earnings Calendar

On the Thursday earnings calendar, we have 41 companies reporting quarterly earnings. Notable reports include SJR.

Top Stories

All 11 sectors of the US market rose yesterday, with traders reacting to an ever so slight improvement in virus infections in New York. However, New York now holds the title of the highest number of diseases in the entire world! Health officials now suggest the actual death tools are 100 to 200 higher each day due to undercounts of those that died at home.

Bernie Sanders dropped out of the Presidential race yesterday, making Joe Biden the presumptive Democratic candidate.

OPEC and allies will meet on Friday with the hope of an agreement to cut oil production as supplies continue to historic levels. There is a possibility that some states may see gas prices fall to near $1.00 per gallon in the coming weeks.

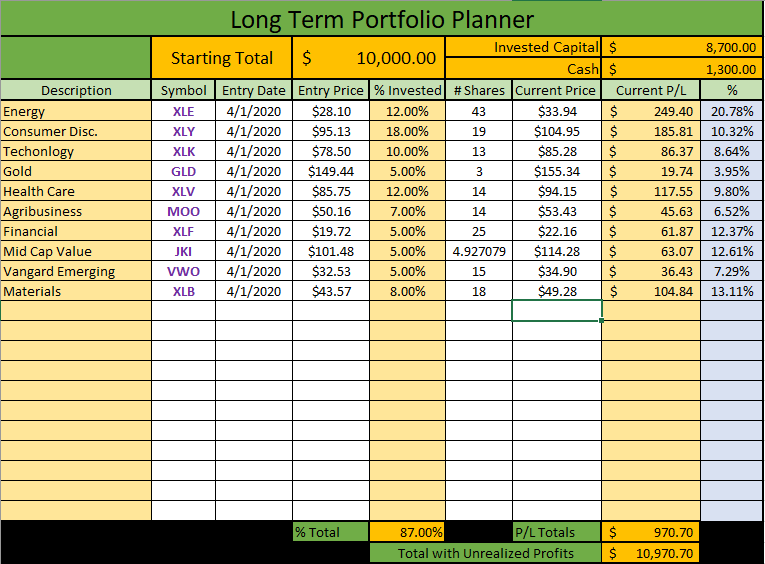

What just a little planning can do in just one week.

Technically Speaking

Yesterday’s rally was broad-based with all 11 sectors of the market seeing gains with the oil and energy sectors leading the way. All the major indexes challenged the resistance of Tuesday’s high, but at the close, all fell just short of breaking out to new weekly highs. The QQQ is in the best technical position of the indexes, having recovered its 200-day average with the IWM continuing to suffer the most substantial damage.

This morning futures point to flat open with all eye focused on the jobless claims number at 8:30 AM Eastern. Consensus estimates suggest an additional 5 million people are out of work this week but keep in mind the forecasts have missed the actual number substantially in the last 2-weeks. That’s understandable because this country has never experienced this level of unemployment. How that translates into company earnings that begin next week is anyone’s guess. Friday, we will get the latest reading on CPI, but the market will have to wait to react because of the Good Friday closure. I wish you all a 3-day happy Easter weekend. Stay safe, my friends.

Trade Wisely,

Doug

Comments are closed.