Sunday afternoon, the FOMC made a surprise mid-meeting decision to cut interest rates to zero and aggressively inject another 700 billion. An action that would typically bring the bulls charging back had an opposite effect scaring the market and pushing the futures limit down just minutes after opening Sunday evening. It appears the Friday gains disappeared in one fell swoop on the weekend reversal. Price volatility will be extreme at the market open and don’t be surprised it we trip another circuit breaker halting trading for 15 minutes shortly after the open.

Asian markets closed down across the board, and European markets are falling as much as 8% this morning. Downside pressure could easily create new market lows this morning as panic grips the market unable to come to grips with the outbreak impacts. Protect your capital as extreme price volatility is likely to continue for the near future.

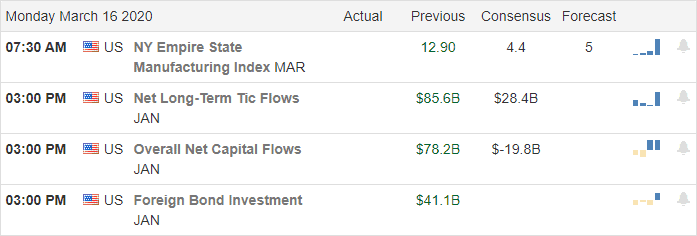

Economic Calendar

Earnings Calendar

We have a big week of earnings reports starting Monday with more than 160 companies reporting results. Notable reports include COUP, HQY, REV, & TME.

Top Stories

The Government is pulling out all the stops trying to stop the market from bleeding out. Friday, the President declared a National Emergency, freeing up 50 billion dollars for stimulus setting of a strong buying rally into the Friday close. Late afternoon on Sunday, the FOMC made a second mid-meeting decision to cut the interest rates to 0% and stepping up aggressive operations to the tune of 700 Billion. The action was not received well by the market, with the Futures dropping limit down in about 15 minutes after opening Sunday evening, and treasury yields fell sharply.

The CDC is asking to cancel or postpone all group activities of 50 people or more. California and New York have ordered closures of bars, night clubs, restaurants, and other states are soon to follow. New York is also closing its schools. Las Vegas has started to shut down as well, with all the MGM and Wynn resorts closing its doors this week.

Piling on to the bad news, Apple has been fined 1.2 Billion Dollars by French antitrust authorities early this morning.

Technically Speaking

The Friday afternoon rally allowed the QQQ to recover its 500-day average closing the week with a little hopefulness of a relief rally. Sadly that hopefulness faded quickly after the shocking FOMC action scaring the market that things but be much worse than anticipated. With the market in full-on panic mode, there’s not much to hang our hat on technically with such wild emotional swings. With the futures, limit-down expect an open that wipes out the entirety of Friday’s gains and the possibility of new market lows. Don’t be surprised if a circuit breaker trips shortly after the open halting trading for 15 minutes for the 3rd time in under a week.

It goes without saying this is a very dangerous market with no relevant metrics to guide traders as to what comes next. We know the impacts are going to be huge but were trying to shoot at a target in total darkness with no idea how long the night will last. Anything is possible, and the best traders can do is protect their capital by standing aside while the violent price action continues.

Trade Wisley,

Doug

Comments are closed.