This afternoon President Biden will unveil his more than $2 trillion infrastructure proposal as the first part of his recovery plan. If approved, it will raise the Corporate Income tax to 28%. Inflation concerns continue to weigh on investors’ minds, with the 10-year treasuries holding above 1.73% and the Case-Shiller, showing that housing prices grew faster over year over year over more than 15 years. Jobs data will be in focus the rest of the week, with Private Payrolls coming in before today’s open.

Overnight Asian markets saw declines across the board after coming under criticism for withholding pandemic data in its report to the WHO. European markets trade with modest losses this morning, worried about rising inflation. Ahead of a busy day of earnings, economic data, and the unveiling of the infrastructure plan, U.S. futures point to flat and mixed open.

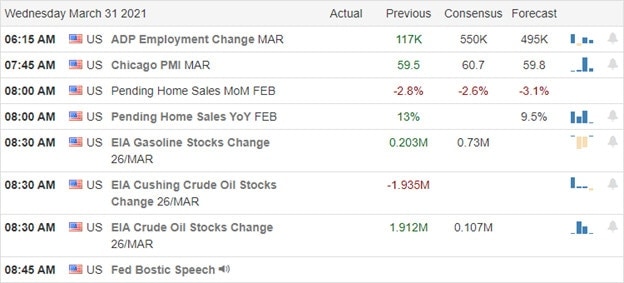

Economic Calendar

Earnings Calendar

On the hump day earnings calendar, we have more than 100 companies listed, but a considerable number of them are not verified. Notable reports include WBA, MU, AYI, AESE, FUV, CONN, DGLY, GES, NG, & VRNT.

News and Technicals’

President Biden will unveil his infrastructure plan with more than $2 trillion in government spending over the next 8-years. Included in the proposal is a Corporate Tax increase to 28%. The second part of his plan will include Health Care and child care spending of another $2 trillion. The Amazon-backed food delivery company, Deliveroo, had a rough beginning in its London IPO, dropping over 30%. Those pesky 10-year Treasury bonds pulled back slightly yesterday but currently holding a 1.73% keeping the pressure on inflation worries. The Fed is also under pressure after the Case-Shiller Index posted housing prices were up 11.2% year over year, which is the most significant annual increase in more than 15-years. Critics point out the Fed is responsible for the sharp inflationary spike in housing due to its commitment to near-zero rates and its continued buying of mortgages- backed securities that total more than $2.2 trillion. The Fed now owns a full 1/3rd of the mortgage-backed securities market!

On the technical front, the DIA trend remains very bullish, and SPY is in good shape holding above price supports though it still struggles to join in on the record-breaking levels. IWM had a good day with the bulls defending critical price support as the financial sector gained ground. The QQQ continues to languish under its 50-day average, weighed down by rising bond rates. Jobs data will focus on the remainder of the beginning, with the private payroll number this morning. Keep in mind as you plan your risk forward of the Good Friday market shutdown.

Trade Wisely,

Doug

Comments are closed.