With the NASDAQ setting a new record, and the SP-500 within striking distance, the index technicals’ improved through overhead resistance in the DIA, IWM, and SPY are still a concern. The Dow remains the most significant concern after rallying 670 points off Friday’s low; it must yet deal with its 50-day average as resistance. Despite antitrust probes and bipartisan-supported proposed antitrust legislation, the tech giants did the vast majority of the market recovery, with Microsoft briefly hitting a two trillion market cap. We’ve come a long way in just two trading days. Remember to take some profits!

Asian markets traded mixed overnight, but the HSI was on fire, surging 1.79% by the close. With a stronger than expected PMI and inflation worries creeping in, European markets trade primarily in the red this morning though the FTSE is clinging to modest gains. Ahead of earnings and housing data, the U.S. futures currently suggest a flat to modestly bullish open. As you plan your day, keep a close eye on overhead resistance levels that may harbor entrenched bears.

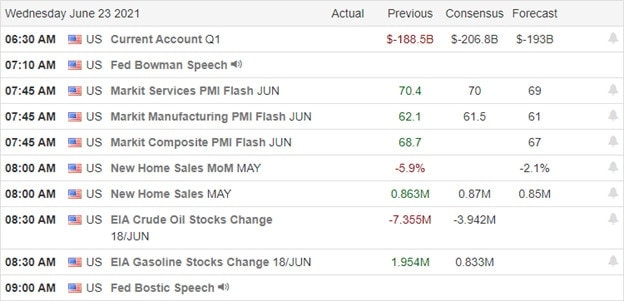

Economic Calendar

Earnings Calendar

On the hump day earnings calendar, we have nine companies listed on the calendar though some are unconfirmed. Notable reports include FUL, INFO, PDCO & WGO.

News & Technicals’

Although pressed several times pressed with hyperinflation questions, Jerome Powell stuck to his guns, suggesting the recent spike is likely temporary. All we can do is hope he’s right as the Fed continues to pump 120 billion a month into the system. The China crypto crackdown continues to impact Bitcoin prices falling below 30,000 once again. The new Delta variant of Covid is likely to become the dominant strain in the next couple of weeks, according to Dr. Fauchi. He has declared this strain as the greatest threat to the attempt to eliminate the virus. In the U.K., consumer price inflation came in 2.1%, and chief economist Andy Haldane urges policymakers to cut their quantitative easing program or risk what he calls the “tiger of Inflation” incoming. The Eurozone business activity surged to its highest levels in 15-years. However, as inflation worries crop up worldwide, U.S. Treasury yields saw little movement this morning, with the 10-year holding at 1.472% and the 30-year drifting slightly lower to 2.102%.

The index technicals improved substantially, with the tech giants doing the vast majority of the heavy lifting. The NASDAQ closed at a new record high, and the SPY is within striking distance of new records though the index has more stocks moving sideways to down than those moving up. The DOW remains the weakest of the indexes, still below its 50-day average though it has surged 670 points off Friday’s low in just two trading days. The VIX has calmed substantially but has not made a new low as one would expect, with new index records being set. That said, traders should remain vigilant as huge price volatility is possible with the DIA, SPY, and IWM still facing overhead resistance. Remember, when the market moves big, it’s a good idea to take some profits along the way.

Trade Wisely,

Doug

Comments are closed.