Perhaps the most macabre candlestick in name, the Hanging Man candlestick pattern is said to resemble a hanging man because of its short body and long shadow (which can look like dangling legs). Occurring after an uptrend, this bearish reversal pattern is composed of only one candlestick and it signifies that the prior uptrend is ending. Momentum is decreasing and the direction of the stock may soon be changing (this is especially likely if you can confirm the Hanging Man with decreasing prices the following day). Although identical to the Hammer candlestick in shape, the Hammer occurs at the end of a downtrend, while the Hanging Man sticks to uptrends.

When you see a Hanging Man, you’ve been warned: a price change may soon be on the way. To learn more about this reversal signal, please scroll down . . .

Hanging Man Candlestick Pattern

Formation

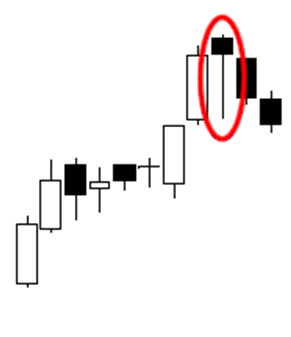

The Hanging Man is composed of only one candlestick, but it must be surrounded by candles that confirm its existence. If you’re trying to identify a Hanging Man candlestick pattern, look for the following criteria:

First, the lower shadow should be long, at least two times the length of the body. Second, there should not be an upper shadow (though a very small upper shadow is sometimes admissible). Third, it must occur at the upper end of the trading range. The color of the body isn’t important, although a black body suggests more bearish results. Fourth, the stock absolutely must be in a definite uptrend before the Hanging Man occurs. Fifth, the Hanging Man must be confirmed on the following day by either a black candle or a gap down with a lower close.

Meaning

An uptrend was happening (the atmosphere bullish), but then the bears stepped up and drove the price down. The bulls fought back, but only temporarily (creating the candlestick’s small body). The uptrend has been exhausted and a bearish reversal is on its way. The buyers are losing control and the bearish traders are gaining strength.

If you want to learn more about the Hanging Man candlestick, study its characteristics and make note of the following details and what each detail implies:

- The longer the lower shadow (the dangling legs), the more likely it is that a reversal will occur and the more bearish the reversal will be.

- If the body of the candle is black, this pattern is slightly more reliable and the results will be more bearish.

- The greater the gap between the Hanging Man’s body and the next candle’s opening price, the more likely it is that a reversal will occur.

The Hanging Man indicates that the preceding trend will soon change, meaning that the market could become flat or move in the opposite direction (i.e., downward). If you spot the Hanging Man, be sure to wait for confirmation before you take action.

– – – – –

If you’re interested in mastering some simple but effective swing trading strategies, check out Hit & Run Candlesticks. Our methods are simple, yet powerful. We look for stocks positioned to make an unusually large percentage move, using high percentage profit patterns as well as powerful Japanese Candlesticks. Our services include coaching with experienced swing traders, training clinics, and daily trading ideas. To sign up for a membership, please click here.

Comments are closed.