A glimmer of relief rally hope appeared yesterday with yesterday’s rebound off intraday lows, leaving behind potentially bullish hammer candle patterns. The question for today can that hammer follow through with bullishness today after big bank earnings, Jobless Claims, and the possible inflationary PPI report. Futures certainly thinks so, as they pump up the premarket adding risk with a large gap into price resistance levels. So which side gains the inspiration after the data, bulls or bears? We will soon find out.

Overnight Asian markets traded mixed but mostly higher, with the HSI still closed for a holiday. This morning, European markets are in a decidedly bullish mood, trading in the green across the board. However, ahead of significant market-moving data, the U.S. futures point to a substantial gap up open. Could it create a short squeeze or just another pop and drop at price resistance that have been so pervasive over the last month of trading?

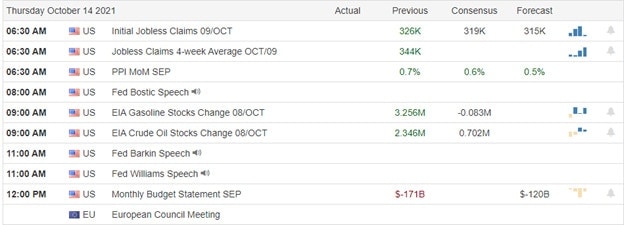

Economic Calendar

Earnings Calendar

We have a busy morning of big bank earnings this Thursday. The earnings calendar has 20 companies listed, yet there are several not verified. Notable reports include UNH, AA, USB, BAC, WFC, C, CMC, TACO, DPZ, MS, TSM, USB, & WBA.

News & Technicals’

Pandemic-related mortgage bailouts are ending, and foreclosures are now rising. Foreclosure starts jumped 32% in the third quarter of this year from the second quarter and were 67% higher than the third quarter of 2020. However, the foreclosure numbers should stay relatively low because of aggressive modifications by lenders and high levels of home equity. According to minutes from the September meeting, the Federal Reserve could begin reducing the pace of its monthly asset purchases as soon as mid-November. The summary, released Wednesday, indicated the tapering process could see a monthly reduction of $10 billion in Treasurys and $5 billion in mortgage-backed securities. Officials at the meeting expressed concern about inflation, saying it could last longer “than they currently assumed.” Treasury yields traded mixed in early Thursday trading with the 10-year dipping slightly to 1.546% and the 30-year rising to 2.058%.

Yesterday’s rebound off the lows left behind bullish hammer candle patterns offers a glimmer of relief rally hope. That said, we still have the significant drama of big bank earnings, Jobless Claims, and another possible inflation stumbling block with the PPI report all before the market opens. However, the relief rally hope has added danger to morning pumping up the premarket futures to suggest a significant gap at the open. That could quickly move indexes right into resistance levels where bears could be entrenched and ready to fight. So, becare chasing the open with a fear of missing out. Instead, give the price action some time to settle, ensuring there will be some follow-through buying because the volatility risk is still high. There is also a possibility of triggering a short squeeze if the data can sufficiently inspire the bulls. However, should the bears find inspiration in the reports, watch for the dreaded pop and drop that has become so prevalent over the last trading month.

Trade Wisely,

Doug

Comments are closed.