Wild gaps continue to chop up traders accounts that try to hold positions overnight. Thursday’s gap down trapped long traders and those that held short positions overnight will this morning fell the bite of the trap. I’ve been warning that for a while that the current market condition favors day traders has certainly been validated this week.

Now facing an uncertain holiday weekend traders have some big decision to make. Hold positions into the weekend rolling the dice for the Tuesday open or close positions to avoid the risk? I for one choose the latter and will slide into the weekend with my capital and weekly gains tucked safely away. After the morning rush we could see light and choppy price action as trader’s head for the door to get an early start to the weekend. Consider your risk carefully!

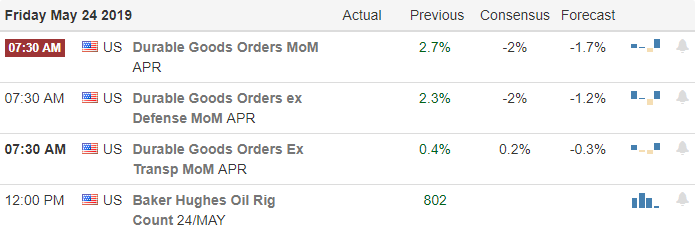

On the Calendar

We have a light day on the Earnings Calendar with only 13 companies reporting. Notable reports include BKE, DXLG, FL, and HIBB.

Action Plan

This morning the futures are pointing to a significant gap which I am very happy to see but I struggle to understand the bullishness. UK Prime Minister Theresa May resigned this morning and European markets are responding higher on the news. Perhaps, the US markets see this as a signal that Brexit will not happen. Yesterday’s gap trapped those holding long positions and it looks like this morning we will trap those holding short positions just before the long holiday weekend.

The markets wild movements have certainly confirmed my point that swing traders have no edge and this is a day traders market. With the big gap up it is entirely possible that a short squeeze rally could be triggered this morning. It’s also very possible the morning gap finds no buyers ahead of the long uncertain weekend and a pop and drop pattern is the result. After the morning rush I would not be surprised to see the price action become very light and choppy as traders shut down early to begin their holiday. Stay focused on price action and consider the risk carefully you carry into the weekend.

Trade Wisely,

Doug

Comments are closed.