Stock futures climbed on Wednesday as investors analyzed the latest earnings reports and prepared for the FOMC’s monetary policy decision. Microsoft shares fell by over 2% due to the disappointing performance in its cloud business. Boeing is scheduled to report its earnings before the market opens, while Carvana and Qualcomm are set to release their reports after the market closes. The central bank is anticipated to maintain steady interest rates, with attention focused on Chair Jerome Powell for any indications of potential rate cuts in the near future.

European markets continued their positive momentum on Wednesday, trading higher following an unexpected rise in euro zone inflation. According to the European Union’s statistics agency, headline price increases in the 20-nation euro zone climbed to 2.6% in July, up from 2.5% in June. This rise surprised economists, who had anticipated the rate to remain steady, as per a Reuters poll.

Japan’s Nikkei 225 index experienced an uptick as the country’s central bank raised benchmark interest rates to approximately 0.25%, marking the first time since December 2008 that the rate has exceeded 0.1%. Meanwhile, China’s factory activity saw a slight acceleration in its contraction during July, with the official manufacturing purchasing managers’ index (PMI) registering at 49.4. In Australia, inflation for the second quarter increased by 1% compared to the previous quarter, resulting in a year-on-year inflation rate of 3.8%.

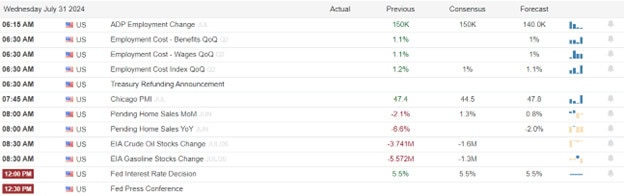

Economic Calendar

Earnings Calendar

Notable reports for Tuesday before the bell include, ATEC, NO, ASC, ATHM, ADP, AN, AVNS, BLCO, BA, CBZ, CDW, COR, CVE, GIB, CHEF, CLH, CNH, CMCO, DAN, DAY, DSX, DD, ENTG, FVRR, FTS, GRMN, GTES, GEHC, GNRG, THRM, ROCK, GSK, HES, HESM, HUM, JCI, KKR, KHC, LNTH, LECO, LIVN, LXP, MAC, MAR, MNRO, EDU, NCLH, OMF, OSW, OPCH, OSK, PSN, PERI, PNM, PUMP, SAGE, SMG, SLGN, SITE, SITE, SR, SCL, STRA, SXC, TEVA, COCO, TKR, TMUS, TT, TTMO, ULS, UTHR, VRSK, WAT, WEC , & WIND. After the bell include ACHC, AFL, AGI, ALB, ALKT, ALL, AIG, AWK, ANSS, AM, AR, APA, ARM, AVB, ACLS, BALY, BKH, BV, CHRW, WHD, CWH, CP, CDNA, CVNA, CAKE, CWAN, CGNX, CTSH, COHU, CODI, CFLT, CRBG, CTVA, CCRN, DLX, EBAY, EIG, ERII, ENVX, EPR, ETD, ETSY, EG, EVTC, EOLS, EXAS, EXPI, FICO, FMC, FORM, FCPT, FNV, GFL, GIL, GKOS, GT, GRBK, THG, HLF, IEX, IRT, NGVT, JAZZ, KRC, KN, KD, LRCX, MGY, VAC, MAX, META, MEOH, MET, MTG, MGM, MAA, MCW, MUSA, MYRG, NFG, NRDS, NTGR, NMFC, NE, OLO, PTVE, PGRE, PK, PAYC, PRDO, PDM, PPC, PTC, QTWO, QGEN, QCOM, QDEL, RDN, RELY, RIOT, RSI, RHP, SDGR, TSLX, SNBR, SON, RGR, SUI, NOVA, TDOC, TENB, TSLX, TTEK, TMDX, UDMY, VICI, WDC, & ZETA.

News & Technicals’

Iranian officials are condemning what they claim was an Israeli strike on Tehran that resulted in the death of Hamas leader Ismail Haniyeh. In a statement, Iranian Supreme Leader Ayatollah Khamenei declared that “the criminal and terrorist Zionist regime has prepared the ground for severe punishment with this action.” As of now, Israel has not commented on Haniyeh’s death.

The Biden administration is once again preparing to forgive the student debt of tens of millions of Americans, following the Supreme Court’s rejection of its initial attempt last year. President Biden has now instructed the U.S. Department of Education to proceed with the regulatory process. In the coming days, the Education Department will start emailing borrowers who may qualify for the widespread loan cancellation, as announced on Wednesday.

Headline inflation in the euro zone unexpectedly increased to 2.6% in July, according to the European Union’s statistics agency. Core inflation, which excludes the more volatile prices of energy, food, alcohol, and tobacco, rose to 2.9% in July, surpassing expectations. The closely monitored services inflation rate was 4% for July, showing a slight decrease from the 4.1% recorded in June.

Japan’s central bank has recently increased its benchmark interest rate to approximately 0.25%, up from the previous range of 0% to 0.1%. This adjustment marks the highest interest rate since October 2008, when it was set at 0.3%. Additionally, the bank announced plans to reduce its monthly outright purchases of Japanese government bonds to about 3 trillion yen ($19.64 billion) per month during the January to March 2026 quarter. These measures reflect a significant shift in monetary policy aimed at addressing economic conditions and stabilizing the financial market.

Hope, hype and uncertainty are likely to wild price volatility today as we wait for the FOMC’s monetary policy decision in between huge numbers of earnings report both before and after the bell today. Futures are pumping the up the premarket strongly so continue to watch for the possibility of whipsaw as the market continues to struggle with breadth.

Trade Wisely,

Doug

Comments are closed.