Jerome Powell is in the unenviable position of being criticized no matter what he does today as the entire world is focused on the Fed rate decision at 2:00 PM Eastern today. Choose to cut the rates a little and market could be disappointed, and Whitehouse tweet barrage will begin. There will likely be criticism within the committee as at least 2-dissenting votes expected to occur suggesting he has bowed to the market. As traders, no matter what the FOMC does, our job is to set aside the bias and trade the chart following our trading plan rules.

Overnight Asian markets closed mixed overall pretty flat on the day as they wait for the FOMC decision. European indexes are however seeing green across the board but only holding very modest gains as they wait. US Futures ahead Housing and Oil Supply numbers point to a flat to slightly bearish open. After the morning rush, I expect very slow and choppy price action until the Fed decision. After that anything is possible, so plan your risk very carefully.

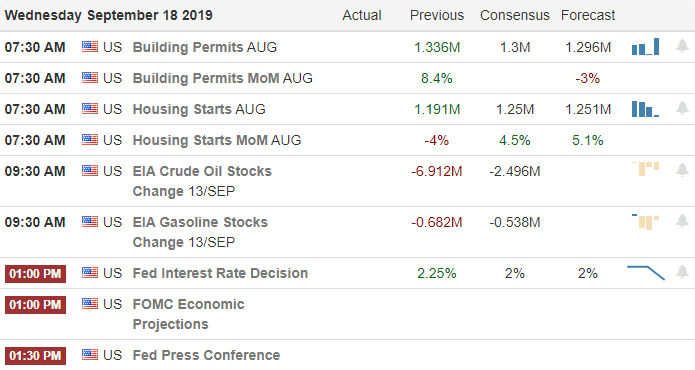

On the Calendar

On the hump day earnings calendar, we have just 11 companies reporting results. GIS is the notable report on the day.

Action Plan

Oil prices moderated yesterday when Saudi Arabia said they have largely restored oil production and should be back to full capacity by the end of the month. Benjamin Netanyahu’s attempt at a 5th term as Prime Minister is struggling this morning as the election is said to be to close to call. It would seem political uncertainty is a worldwide theme these days. Today is all about the FOMC and whether they will or won’t or how much they choose to adjust the interest rates. No matter what Powell will have to face criticism. Cut the rates, and it’s likely there will be at least 2-dissenting votes cast on the committee. Don’t cut the rates enough and expect a barrage of disapproval tweets from the Whitehouse.

No matter what you think or want to happen; as traders, the best we can do is stick to our rules, set aside our bias and trade the chart. We will all know the answer at 2:00 PM Eastern and all the media spin before that is speculation and distracting noise. Currently, US Futures point to flat to slightly bearish open where we can expect choppy price action until the rate decision is released. After that, all bets are off, and anything is possible. If the market embraces the decision new, record market highs look possible. Disappoint the market, and the index charts could easily begin to show topping patterns. Hang on it could be a wild day!

Trade Wisely,

Doug

Comments are closed.