There can be no doubt that the bulls did an extraordinary job in January. As a matter of fact, the news sited it’s the best January since 1987. And the bull continue this amazing effort pushing us even higher? Yes, however, the odds of pullback beginning soon continue to mount even though there is no evidence of such in the price action.

Continued good earnings and a trade deal between the US and China would most certainly continue to provide energy for the bulls to continue running. However, I prefer to be more of a profit taker today than a buyer of new risk as we head into the weekend. Outstanding profits have been made over the last three weeks an I prefer to tuck them safely away in my account before the weekend rather than risk them to the unknown. What will you do?

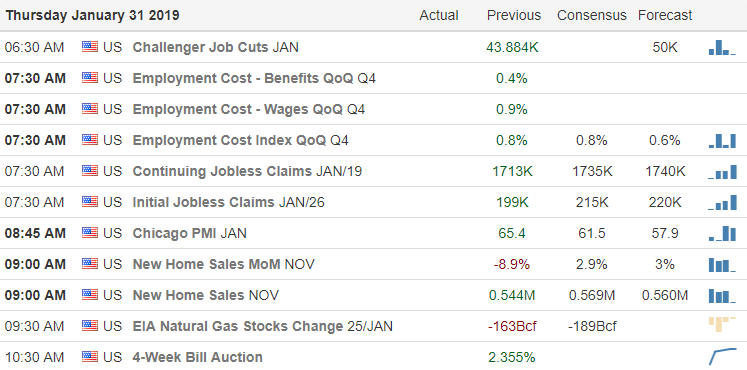

On the Calendar

On the Earnings Calendar, we get a little break today with only 66 companies reporting earnings. Notable earnings include CVX, CI, DB, D, XOM, MRK & WY.

Action Plan

Yesterday we had a bit of split decision with the Dow finishing down 15 points and the SP-500 closing up 23 points. The NASDAQ had the best results reacting to earnings results pushing 98 points higher. As I write this, the Futures currently point to a mixed open, but a lot could change as earnings roll out and the big Unemployment Situation number reveal at 8:30 AM Eastern.

According to the news, this has been the strongest January rally since 1987. The bulls continue to climb the wall of worry charging forward with seemingly boundless energy. No, complaints here because the profits have been great! However, what goes up must certainly come down eventually so stay focused on the price action clues. As we roll into the weekend, I plan to be more of a profit-taker rather than a buyer. Could the market go higher? The answer is a definite, YES, but it’s my opinion that the odds are growing for a pullback. Thus I prefer to have the majority of my capital tucked safely in my account before the weekend.

Trade Wisely,

Doug

Comments are closed.