Energized by earnings, the bulls continue to march toward resistance highs and possible new records if the momentum is maintained. That said, there is a substantial growing risk to traders with unfilled gaps left behind and the rapid extension seen in the index charts. Moreover, as energy prices continue to surge, adding to inflationary concerns and the supply chain bottlenecks clouding the path forward, earnings reports will have a lot to overcome. That said, anything is possible during the highly emotional earning season. So study the risks carefully and trade wisely as the silly season ramps up to include the tech giants.

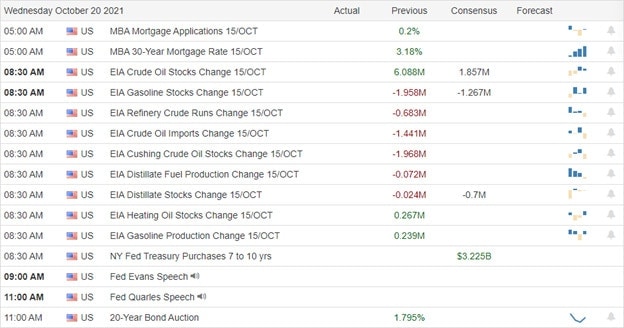

Overnight Asian markets traded mixed with Hong Kong, once again leading the way as Chinese tech surged. This morning European markets seem to be taking a wait-and-see approach with muted gains and losses as they ponder global market sentiment. With a ramp-up in earnings reports and a pending petroleum number, U.S. futures point to a flat open at the time of writing this report.

Economic Calendar

Earnings Calendar

We rap up again today with more than 60 companies listed on the calendar. Notable reports include TSLA, ABT, ANTM, ASML, BKR, BIIB, CP, CFG, CMA, CCI, CSX, DFS, EFX, IBM, LRCX, MMLP, NDAQ, NEE, NEP, PPG, SLG, THC, TZOO, & VZ.

News & Technicals’

Netflix gained 4.4 million new subscribers in the third quarter, but only 70,000 of them came from the U.S. and Canada. The streaming service has added fewer than 1 million new subscribers from the U.S. and Canada in the past 12 months. Netflix said 142 million subscribers have watched at least two minutes of its new hit “Squid Game.” In August, Federal Reserve Chairman Jerome Powell laid out five reasons supporting his view that the current run of high inflation will go away. Powell has plenty of time to be correct, and many professional economists also hold the “transitory” position. However, expectations for inflation among consumers and investors, as well as from some Fed officials, continue to rise. This year, supply chains everywhere have been hit by massive disruptions from container shortages to floods and Covid infections, setting off port closures. “Suddenly retailers and manufacturers are overordering because of these supply chain issues, and that’s just leading to essentially an even worse scenario,” Jonathan Savoir, CEO of supply chain technology firm Quincus told CNBC’s “Squawk Box Asia” on Monday. In addition, the energy crises in mainland China and Europe are the latest to roil the shipping industry. The 10-year Treasury yield topped the highest point since mid-May, rising to 1.67% late Tuesday night and trading at 1.68% early Wednesday morning. The 30-year bonds also rose in early trading to 2.02%.

Though the bulls continue to matain control energized by earnings, we also have a substantial extension in the charts that create a signifiant risk. With the T2122 indicator in a short-term overbought condition, traders should be on the lookout for potential consolidation or even a profit-taking pullback. In addition, the index charts have several unfilled gaps in the recent rally. Surging energy prices continue to add pressure on consumers and the inflationary impacts on everything bought or sold. Supply chain bottlenecks are also a significant concern as we head into the holiday season as worries of empty shelves add additional pricing pressures. Recently the IMF downgraded growth expectations with a warning of global stagflation. Of course, anything is possible during earnings season, and with emotions running, hot traders should expect challenging price volatility to stick around in the weeks ahead.

Trade Wisely,

Doug

Comments are closed.