Do you have an Edge? That is the question I continue to ask myself as we wait on trade talks and a tariff decision. We know the market continues to be very sensitive on this subject, and we experienced yesterday the market could move substantially on any news report or rumor on the subject. Every trader should consider carefully consider their risk as this market-moving decision approaches. If that would not enough, we also have an FOMC rate decision at 2:00 PM Eastern to consider today. Although the expectation is the committee will hold rates steady, a change in the statement or the Chairman’s press conference can create some price volatility.

Overnight Asian markets closed mixed but mostly higher as they closely monitor tariff news and the possibility of a Phase 1 trade deal. European indexes trade mixed but mostly lower this morning ahead of the FOMC rate decision. US Futures ahead of the CPI report indicate a relatively flat and mixed open with the QQQ looking the most bullish, but that could change significantly by the open. Don’t be surprised if indexes become light and choppy as we wait on the FOMC decision that may well prove an overall non-event.

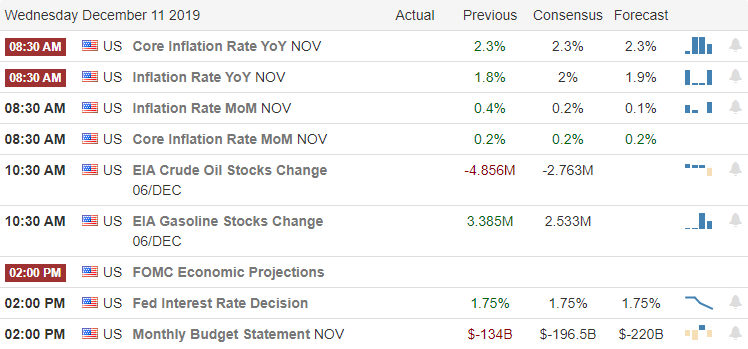

On the Calendar

On the hump day Earnings Calendar, we have 37 companies fessing up their quarterly results. Notable earnings include AEO, LULU, TLRD, PLCE, UNFI, & VRA.

Action Plan

Before the market opens today, we will get the latest reading on the CPI number. Consensus estimates expect a slight decline but could move the market and affect the open if the reading happens to surprise. At 2:00 PM, FOMC will release the results of the 2-day interest rate meeting. Their decision is likely to be a non-event because the expectation is they will hold rates steady and unlikely to change forward projections. Of course, if during the Chairman’s press conference, if we learn something more about their forward-thinking, we could experience some price volatility.

As the House prepares to impeach the President, the main market focus at the moment is the US/China trade deal and, more importantly, what it may mean for the Sunday scheduled tariff increase. We saw the market sensitivity to this yesterday as the pre-market futures quickly recovered due to a Journal report. Then, when the government couldn’t confirm the tariff delay as reported, the market quickly reversed to the negative whipsawing prices. With that in mind, carefully consider your risk as we wait for the Presidents decision.

Trade Wisely,

Doug

Comments are closed.