The bulls did a good job ignoring the economic impacts of inflation throughout the morning session, but around mid-day, the bears emerged from hibernation. Unfortunately, they left some lower highs in the indexes as we began the earning’s high price volatility session. Stock valuations are very high, so companies will have to report solid results. Anything is possible so expect wild price volatility with overnight gaps and reversals traders and investors react in the weeks ahead.

Asian markets closed red across the board even as China exports beat expectations. European markets are also currently red across the board at the time of this report as they react to the hawkish comments from the Fed. However, that is not the case here in the U.S.; futures lean toward a bullish open as we wait for big bank reports and retail sales numbers. So, here comes the silly season!

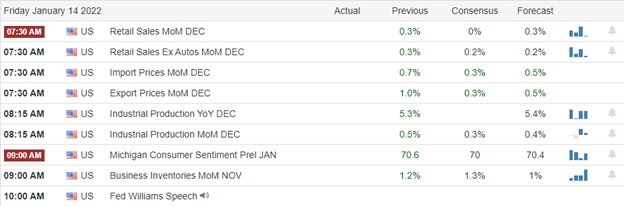

Economic Calendar

Earnings Calendar

Today begins the 1st quarter earnings season kicking off will big bank earnings. Notable reports include BLK, C, FRC, JPM, & WFC.

News & Technicals’

Philadelphia Fed President Patrick Harker said Thursday he sees three or four interest rate hikes this year as likely to fight inflation. The policy tightening would respond to inflation that is running at the highest level in nearly 40 years. While Harker expressed support for hikes and the end of monthly bond purchases, he favors waiting before decreasing the Federal Reserve’s $8.8 trillion balance sheet. In addition, president Joe Biden will nominate Sarah Bloom Raskin to be the Federal Reserve’s next vice chair for supervision, a powerful regulatory role. According to a person familiar with the matter, Biden will also nominate Lisa Cook and Philip Jefferson to serve as Federal Reserve governors. The nominations come at a precarious time for the Fed, which has signaled it will soon move to raise interest rates to fight inflation in recent weeks. Navient, one of the largest student loan servicers, will cancel $1.7 billion in private student loans after a deal it reached with 39 states. The lender was accused of giving out private loans to students who could not pay them. As part of the settlement, Navient denied that it violated the law. On Thursday, the Supreme Court blocked the Biden administration from enforcing its sweeping vaccine-or-test requirements for large private companies. But the conservative-majority court allowed a vaccine mandate to stand for medical facilities that take Medicare or Medicaid payments. The OSHA mandate required that workers at businesses with 100 or more employees get vaccinated or submit a negative Covid test weekly to enter the workplace. Treasury yields were again on the rise in early Friday trading, with the 10-year trading up to 1.7398% and the 30-year rising slightly to 2.0796%.

Although the market tried hard to ignore the economic impacts of inflation by mid-day, the bears went to work, creating some technical damage, particularly in the tech sector. The lower high failures in SPY and QQQ are the most concerning and suggest more selling, BUT we have earnings to consider. As we have seen in the past, earnings can disrupt any hint of bearishness if companies beat analysts’ estimates. However, with current stock valuations so incredibly high, even the slightest miss could result in some swift punishment in price. So, long story short, plan carefully and avoid over speculation. Anything is possible, and we can expect substantial price volatility with overnight gaps and reversals possible. So, fasten your seatbelt; silly season has begun!

Trade Wisely,

Doug

Comments are closed.