Although the earnings and economic data pointed to significant economic weakness, the bulls went to work defending 2020 market lows on Thursday. However, the rally continued to show weak volume, and index prices remain under significant technical and price resistance. So that raises the question, can they follow through with the second day of bullishness filled with market-moving earnings and economic reports? We will soon find out but prepare for challenging price action by watching for whipsaws and possible complete reversals if the data inspires the bears.

Asian markets closed mixed but mostly lower overnight as China’s GDP missed expectations. European markets are, however, in bullish mode this morning, showing green across the board. Ahead of a big day of data, U.S. futures defy weak economic conditions and inflation pointing to a bullish open even as bad bank results roll in. Plan carefully headed into the uncertainty of the weekend.

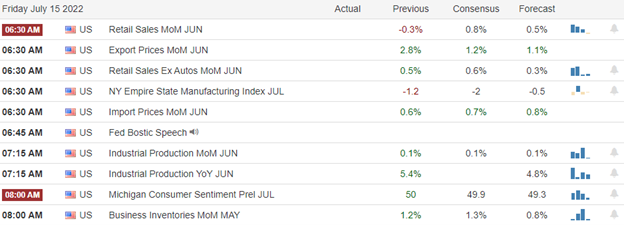

Economic Calendar

Earnings Calendar

The bank majors dominate the earnings calendar today. Notable reports include BK, BLK, C, PNC, STT, USB, UNH, & WFC.

News & Technicals’

On the one hand, Dimon said the U.S. “economy continues to grow and both the job market and consumer spending, and their ability to spend, remain healthy.” “But geopolitical tension, high inflation, waning consumer confidence, the uncertainty about how high rates have to go, and the never-before-seen quantitative tightening and their effects on global liquidity … are very likely to have negative consequences on the global economy sometime down the road,” he warned. The best way to stabilize oil prices is to boost supply, and alternatives to Russian oil are available to the world, said Mathias Corman, the secretary-general of the Organization for Economic Cooperation and Development. On Thursday, U.S. Treasury Secretary Janet Yellen said a cap on Russian oil prices would be crucial to bringing down inflation. Industry players told CNBC an improving macroeconomic picture, particular trading patterns, and further shakeout or “deleveraging” could help bitcoin and the crypto market find a bottom. This could mean further downside for bitcoin to as low as $13,000, will remove the “last remaining weak hands.” There have been high-profile collapses in the latest “crypto winter,” including lender Celsius and hedge fund Three Arrows Capital. China eked out GDP growth of 0.4% in the second quarter from a year ago, missing expectations as the economy struggled to shake off the impact of Covid controls. Analysts polled by Reuters had forecast growth of 1% in the second quarter. However, retail sales in June rose by 3.1%, recovering from a prior slump and beating expectations for no growth from the prior year. In the second quarter, mainland China faced its worst Covid outbreak since the height of the pandemic in early 2020. Starbucks will close 16 U.S. stores, mostly on the West Coast, by the end of July because of safety concerns. Six stores will close in Greater Los Angeles; six in Greater Seattle; two in Portland, Oregon; one in Philadelphia and D.C. The move comes as more than 100 stores have voted to unionize since the end of 2021. Bond yields declined slightly in early Friday trading, with the 2-year slipping to 2.93% and the 30-year dipping to 3.09%. However, the 2-year remains inverted over five, ten, and 30-year bonds, pricing at 3.12% this morning.

Disappointing bank earnings, rising jobless claims, and a near-record PPI reading started Thursday with an ugly gap down, but the bulls used that move to buy, defending 2020 market lows. The T2122 indicator did show a short-term oversold condition at the morning gap down, but the rally is not very convincing so far. Volume remained suspiciously low, and the indexes remain beneath significant technical and overhead resistance. Today we face a bigger day of bank earnings, so if you’re a bull, let’s hope the JPM and MS result don’t become expand into a bearish 3rd quarter theme. Adding to the potential price volatility are Retail Sales, Empire Start MFG., Import & Export Prices, Industrial Production, and Consumer Sentiment data to keep traders guessing as we head into the uncertainty of the weekend. It could be a hectic day ahead, so plan carefully!

Trade Wisley,

Doug

Comments are closed.