The market found some levity yesterday after the R’s offered the D’s a short-term debt ceiling solution providing the bulls the necessary energy to defend support levels. The relief was nice, but the rally did not resolve overhead resistance, chart technical damage, overall downtrends. This morning we will turn our attention toward Jobless Claims and then might see some choppy price action as we wait for the Friday Employment Situation data. Because the D’s don’t much like the offer, expect the debt ceiling battle to create more bumps in the market as they toss sound bites at each other.

With China’s markets still closed, all other Asian markets traded higher overnight, with the HSI shaking off developer defaults to rise 3.07%. European markets are also in relief rally mode this morning, seeing nothing but green across the board. Ahead of Jobless Claims and buoyed by a possible debt ceiling solution, futures point to a bullish gap open but watch overhead resistance levels for entrenched bears that might not give as easily as they have before.

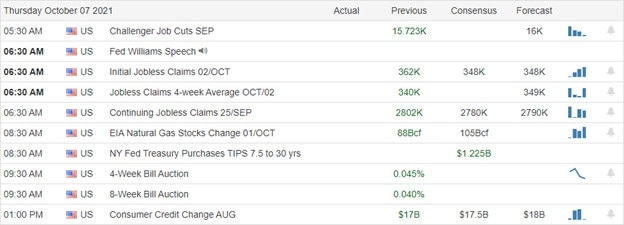

Economic Calendar

Earnings Calendar

Although we have more companies listed on the earnings calendar than we have seen all week, most of them are unconfirmed. The only notable reports I could come up with are CAG & HELE.

News & Techniclals’

On Wednesday, Senate Minority Leader Mitch McConnell offered a short-term suspension of the U.S. debt ceiling to avert a national default. “We will also allow Democrats to use normal procedures to pass an emergency debt limit extension at a fixed dollar amount,” McConnell wrote. The stopgap offer from McConnell would take some pressure off both parties to reach a compromise by Oct. 18, when the government says they could default. But, of course, the Democrats are not happy with the proposal and will likely take the fight right up to the deadline. Russia rode to Europe’s rescue and offered to increase gas supplies to the region amid soaring prices on Wednesday. Experts said the move showed Europe is now essentially at Russia’s mercy when it comes to energy. Of course, the U.S. has been warning for years that, just as the U.S. had warned. Natural gas contracts hit new highs in Europe this week — and regional benchmark prices are up almost 500% so far this year. Toy manufacturers are grappling with a massive bottleneck in the global transportation pipeline caused by the coronavirus pandemic and worsened by the blockage of the Suez Canal in March. Power outages in China, a resin shortage, and higher labor costs have also strained the supply of goods and increased prices. MGA Entertainment had anticipated 50% sales growth this year but now expects to grow by 18% to 20%. Treasury yields fell slightly this morning, with the 10-year slipping less than one basis point to 1.516% and the 30-year dipping less than one basis point to 2.069%.

After hearing that the GOP offered a short-term debt ceiling solution, the bulls got busy defending price supports and ending a very volatile whipsawing morning session. However, the Democrats don’t like the offer, and we can expect this political drama to extend to the deadline. Unfortunately, yesterday’s rally did not resolve any of the charts’ technical damage, so we will still have to closely watch overhead resistance levels that may harbor entrenched bears. This morning the market will turn its attention to the Jobless claims number that has proved problematic over the last couple readings. Though futures are pumping up the premarket, keep in mind with the Employment Situation number looming Friday morning, it would not be uncharacteristic for the price action to become light and choppy as we wait. Also, keep in mind the Shanghai will reopen tonight, having to catch up with the developer default impacts.

Trade Wisely,

Doug

Comments are closed.