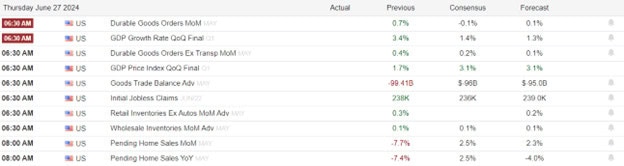

Thursday’s trading session began on a subdued note as stock futures as the market’s reacted earnings reports and market-moving data anticipation. Today investors face a busy morning of earnings and economic reports. Traders are poised to assess the latest data on weekly jobless claims, durable goods orders, pending home sales figures and the latest reading on GDP.

European markets exhibited a cautious stance on Thursday. The pan-European Stoxx 600 index saw a modest decline, edging down by 0.2% as of 11:15 a.m. London time. Media stocks managed to buck the trend, gaining 0.44%, which could suggest a shift in investor focus towards more defensive sectors. On the other hand, the retail sector faced a significant pullback, dropping 1.78%, possibly due to the impact of inflationary pressures on consumer spending and sentiment.

In a significant shift in the currency market, the Japanese yen experienced a substantial depreciation, reaching a nearly 38-year low. Late Wednesday, it plummeted to 160.82 against the U.S. dollar, marking a notable milestone as reported by FactSet. Despite the yen’s weakening, Japan’s domestic economic indicators painted a more robust picture. Retail sales in May outperformed expectations, registering a 3% year-on-year growth, surpassing the anticipated 2% forecasted by a Reuters poll of economists. Meanwhile, China’s economic landscape also showed signs of strength, with industrial profits witnessing a 3.4% increase from January to May.

Economic Calendar

Earnings Calendar

Notable reports for Tuesday before the bell include AYI, APOG, LNN, MCK, SMPL, & WBA. After the bell include NKE, & ACCD.

News & Technicals’

Micron Technology, a leading chipmaker, experienced a surprising 7% drop in its share value on Wednesday, despite reporting quarterly results that surpassed expectations. This decline occurred even though the company’s revenue guidance met analysts’ estimates, suggesting that other factors may be influencing investor behavior. Over the past year, Micron’s stock has seen a remarkable surge, more than doubling in value, largely attributed to the burgeoning demand for chips in the artificial intelligence sector. This sector’s rapid growth has been a significant driver for the semiconductor industry, with Micron being one of the beneficiaries of this trend. However, the recent dip in share price indicates that even companies at the forefront of technological advancements are not immune to market volatility.

Levi Strauss, the iconic denim brand, encountered a slight setback as it narrowly missed Wall Street’s sales expectations, despite denim’s growing popularity. The company’s Chief Financial Officer expressed concerns, noting that consumers are exercising caution with their spending, particularly regarding discretionary items. This cautious consumer behavior could reflect broader economic trends or a shift in spending priorities. In response to the evolving retail landscape, Levi Strauss has been strategically reducing its dependence on department stores. The brand is expanding its direct-to-consumer channels, including enhancing its own website and brick-and-mortar stores. While this move aims to establish a more direct relationship with customers, it also presents its own set of challenges, such as increased competition in the digital space and the need for strong online user experience.

Wall Street is poised with anticipation for the release of May’s personal consumption expenditures (PCE) price index on Friday, a key indicator of inflation. Investors are hopeful that the report will reveal a softening of inflationary pressures, which could reinforce the possibility of the Federal Reserve reducing interest rates later in the year. Amidst this backdrop, there is an ongoing debate among investors regarding the sustainability of the artificial intelligence (AI) sector’s influence on market performance. As the year progresses, questions arise about whether the AI-driven market rally can maintain its momentum or if a broader range of sectors will need to contribute to market growth. According to strategists surveyed by CNBC Pro, there is a tempered expectation that the S&P 500 will conclude the year with a marginal increase, potentially less than 1% above the current levels. This forecast reflects a cautious outlook on the market’s trajectory in the face of various economic uncertainties.

As we wait with massive data anticipation, remember it doesn’t really matter what the data is, it’s the market reaction that matters. Unfortunately, being unable to see the future we must be prepared for the possibility of big point gaps and whipsaws as the market tries to price in the new information. Keep in mind we’re facing the Core PCE number Friday morning so plan for the price volatility and uncertainty to continue.

Trade Wisely,

Doug

Comments are closed.